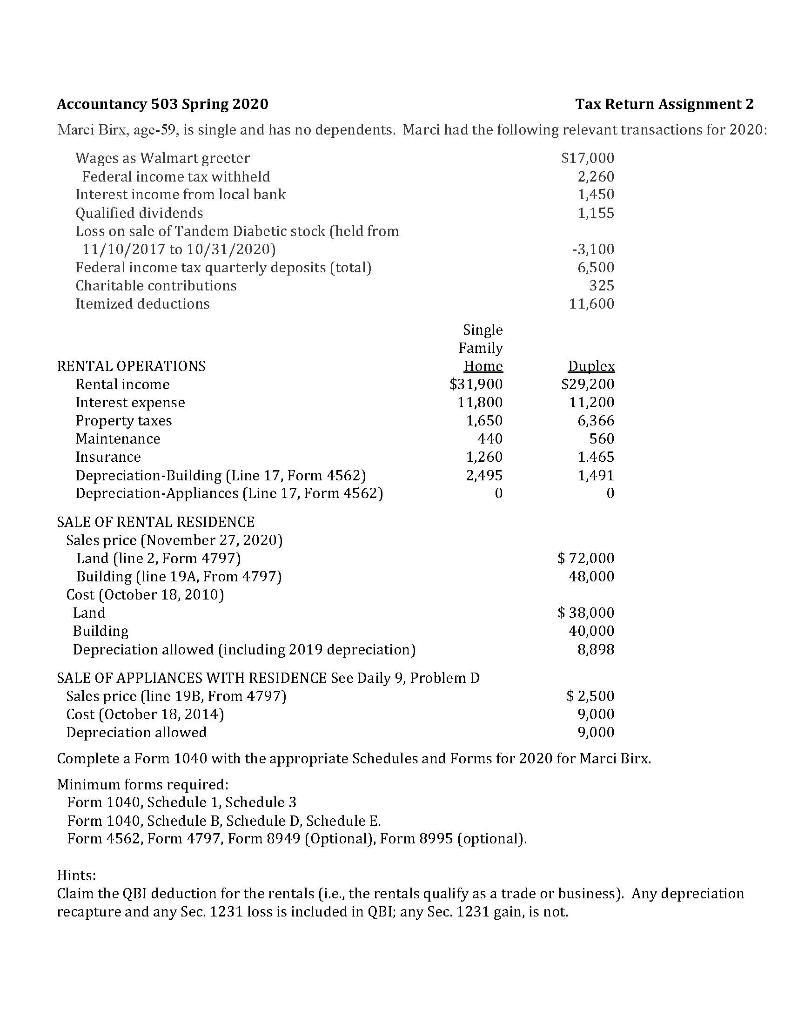

Home Virginia TaxSignNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you All you need is smooth internet connection and a device to work on Follow the stepbystep instructions below to esign your 17 form 4797Instructions included on form MI1310 Claim for Refund Due a Deceased Taxpayer N/A MI2210 Underpayment of Estimated Income Tax Instructions included on form MI4797 Adjustments of Gains and Losses From Sales of Business Property Instructions included on form MI49 Sales and Other Dispositions of Capital Assets Instructions

How To Report The Sale Of A U S Rental Property Madan Ca

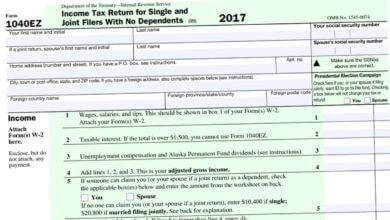

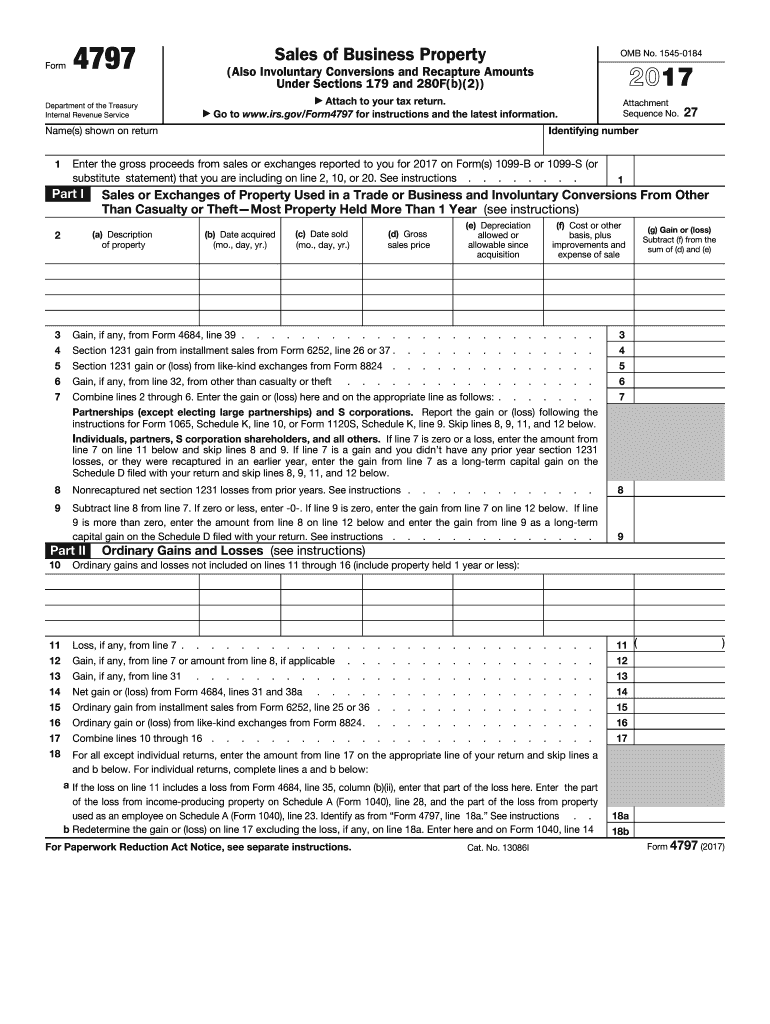

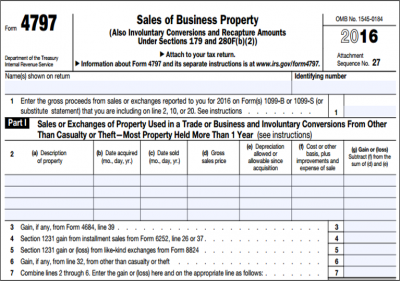

Form 4797 instructions 2017

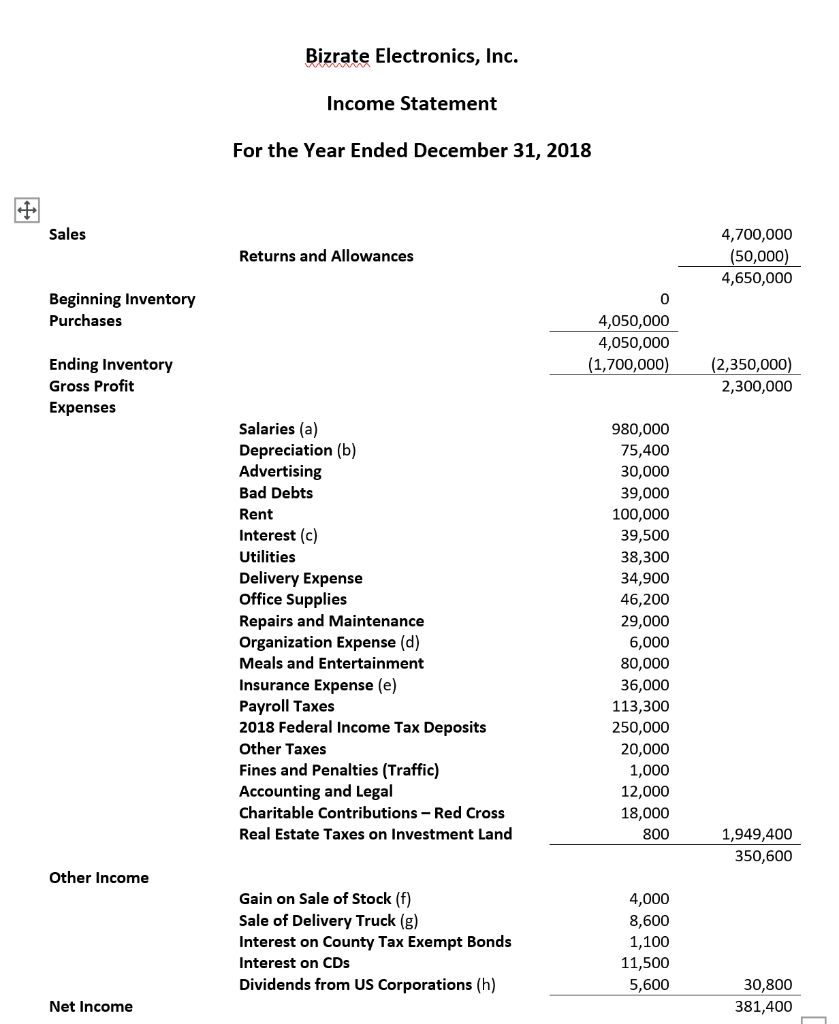

Form 4797 instructions 2017-Investment Advisers Act Release No 4797;Jan 07, 21 · The IRS form 4797 is a PDF form which can be filled using a PDF form filler application The IRS form 4797 is used to report, Real property used in your trade or business, depreciable and amortizable tangible property used in your trade or business and many other similar properties

Tax Forms Irs Tax Forms Bankrate Com

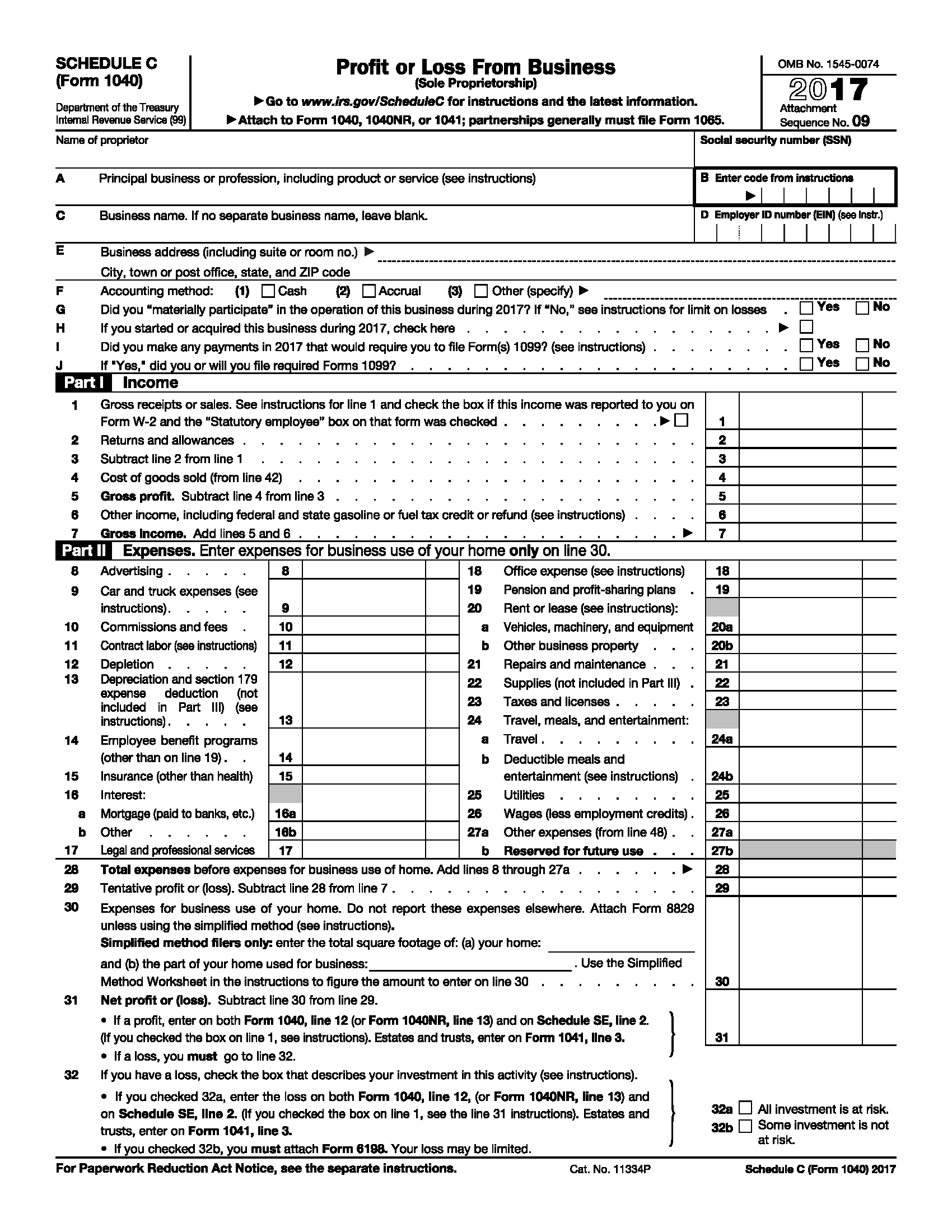

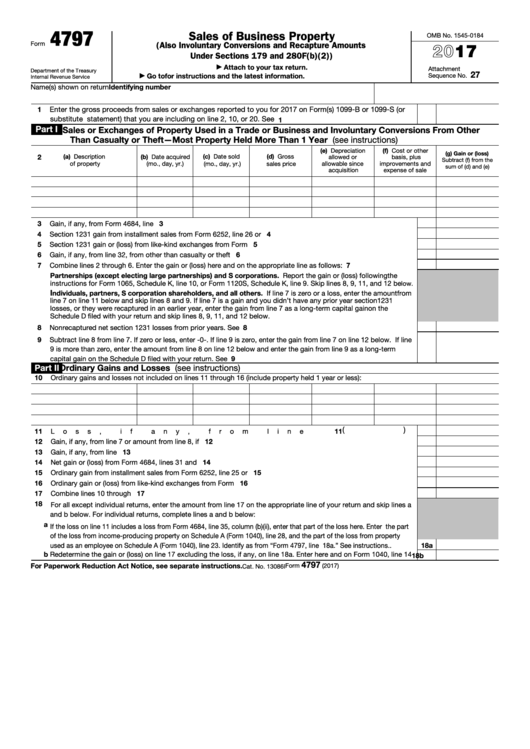

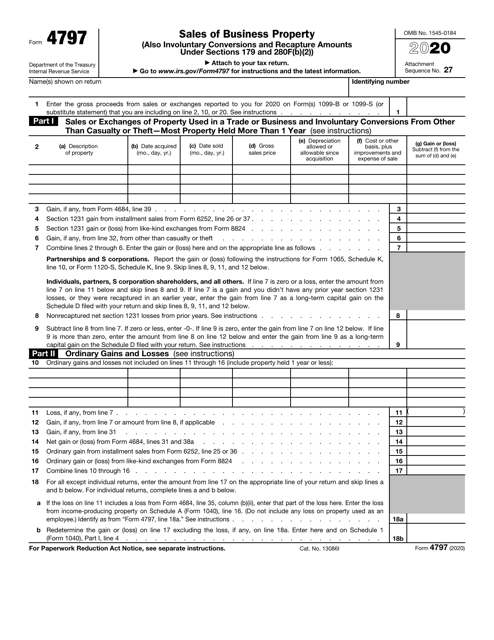

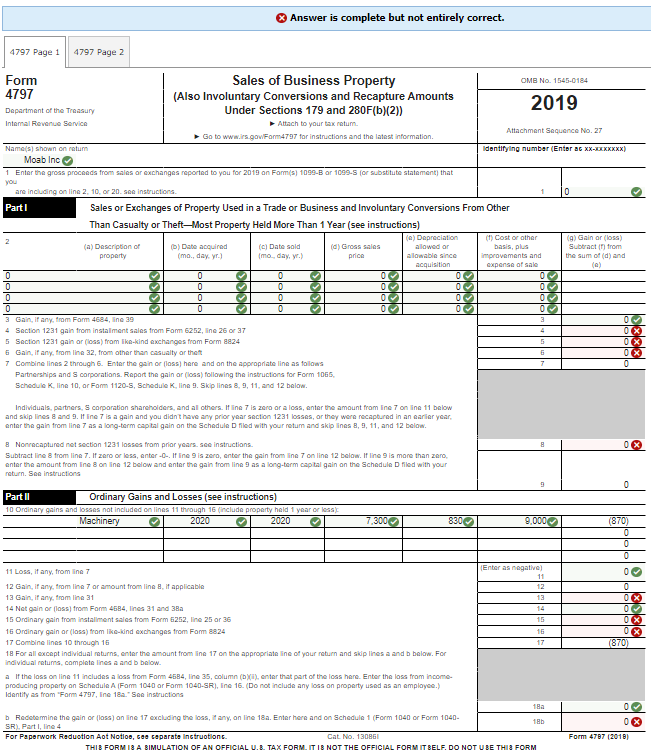

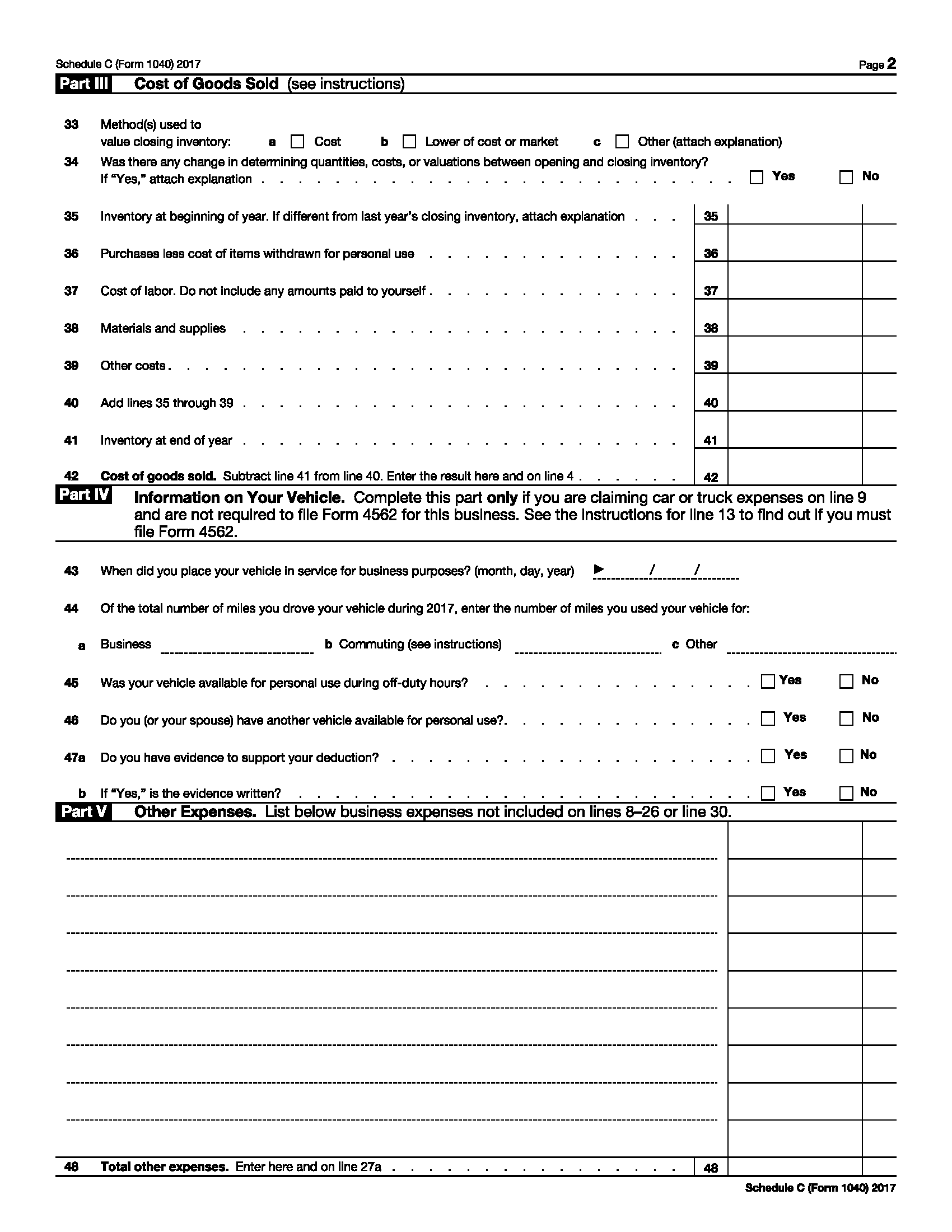

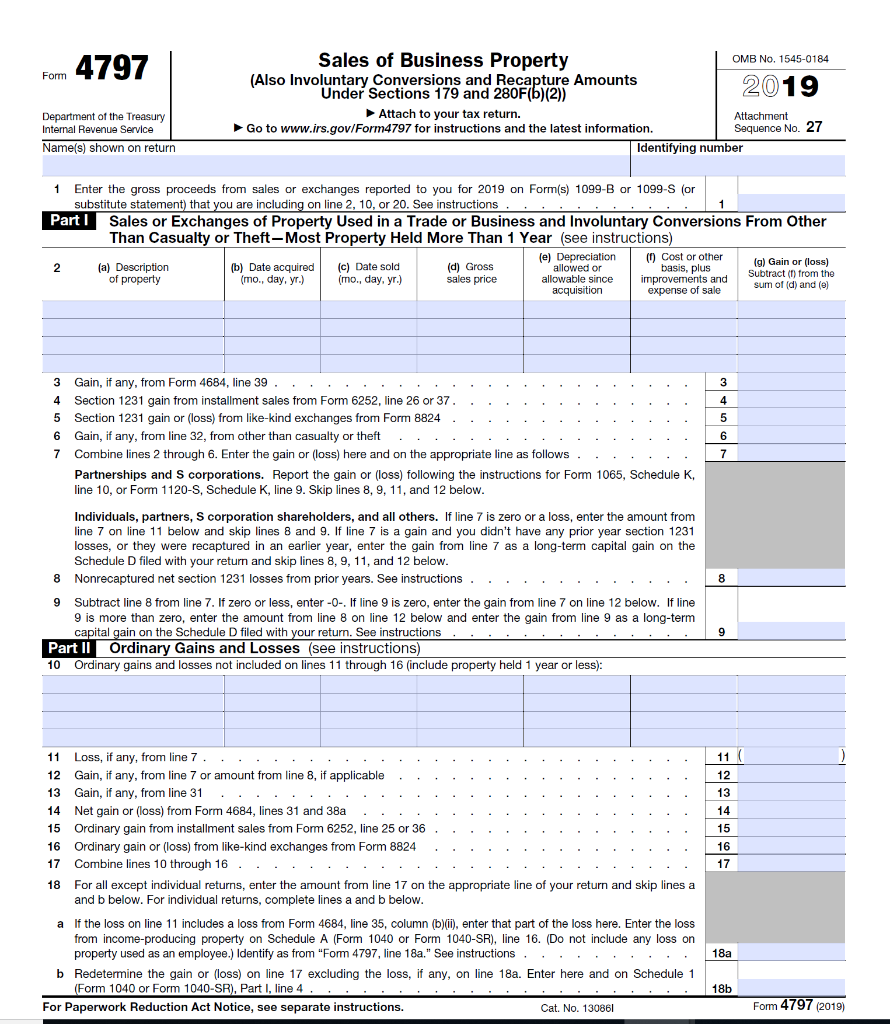

6/13/17 2 Center for Agricultural Law & Taxation Form 4797 • The instructions should be reviewed and will be helpful in what parts to be filled out and how to determine gain, loss and character 4 Center for Agricultural Law & Taxation Form 4797 Purpose of Form • The sale or exchange of • 1 Real property used in a trade or businessForm 4797 instructions Take full advantage of a electronic solution to create, edit and sign contracts in PDF or Word format on the web Transform them into templates for numerous use, add fillable fields to collect recipients?Form 4797 Sale of Business Property Force to Part II To enter a loss for the sale of business property not entered in TaxAct® as an asset for depreciation From within your TaxAct return (Online or Desktop), click Federal On smaller devices, click the menu icon in the upper lefthand corner, then select Federal;

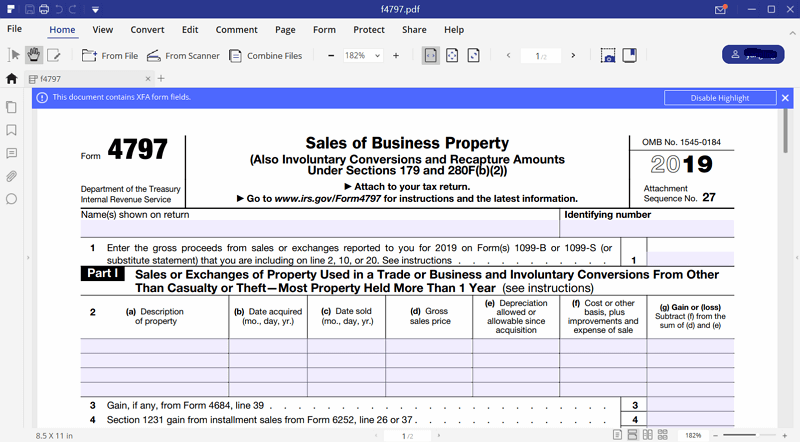

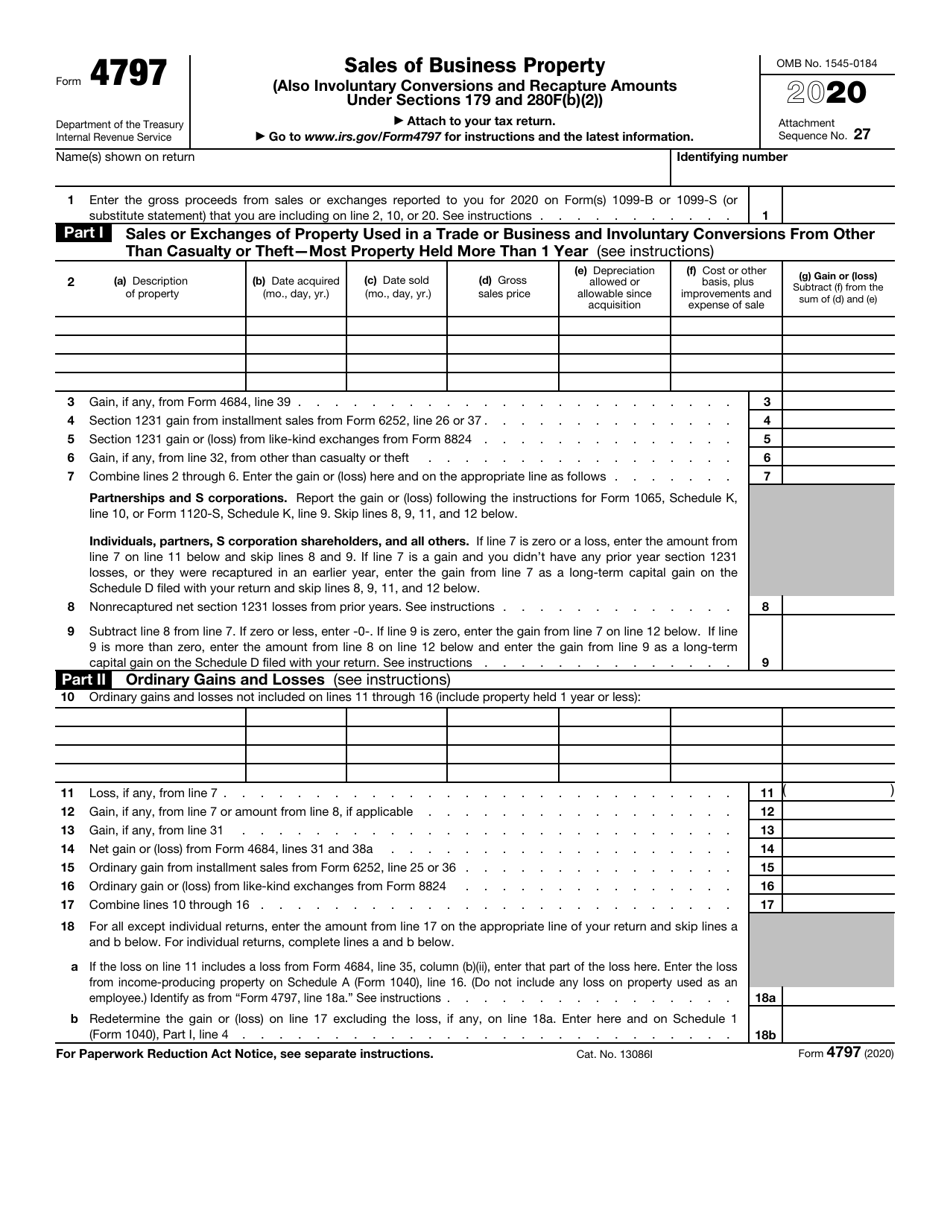

Form 4797 is a tax form required to be filed with the Internal Revenue Service (IRS) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or17 Form 4684 I4648A F4684 UserManualwikiJun 05, 19 · it is a 1065 k1 the k1 has a 17 sales schedule which shows ordinary gain to be posted to form 4797 part 11 line 10 and an amt adjustment for form 6251 line 17 this has to do with a stock exchange (one entity for another with no cash exchanged) which is a taxable transaction (a limited partnership's stock exchanged for a corporation's stock) i need to know how to access the forms

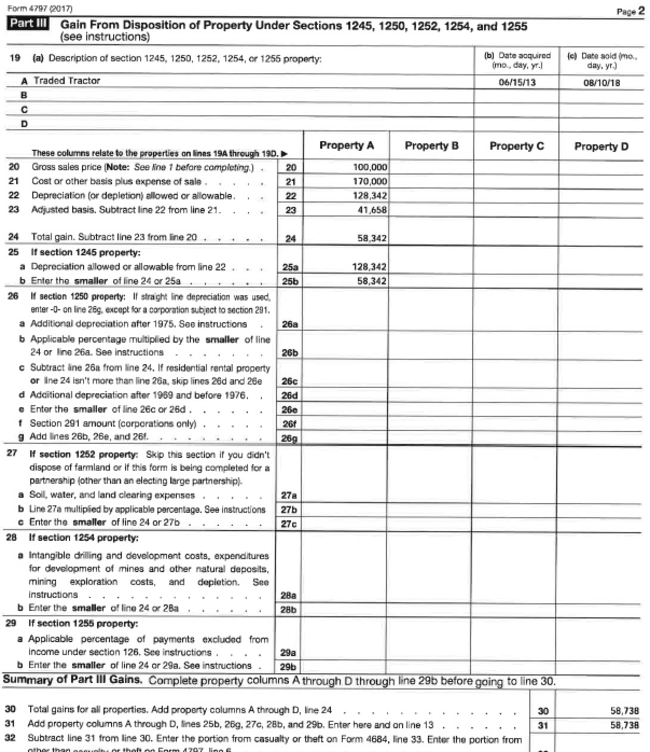

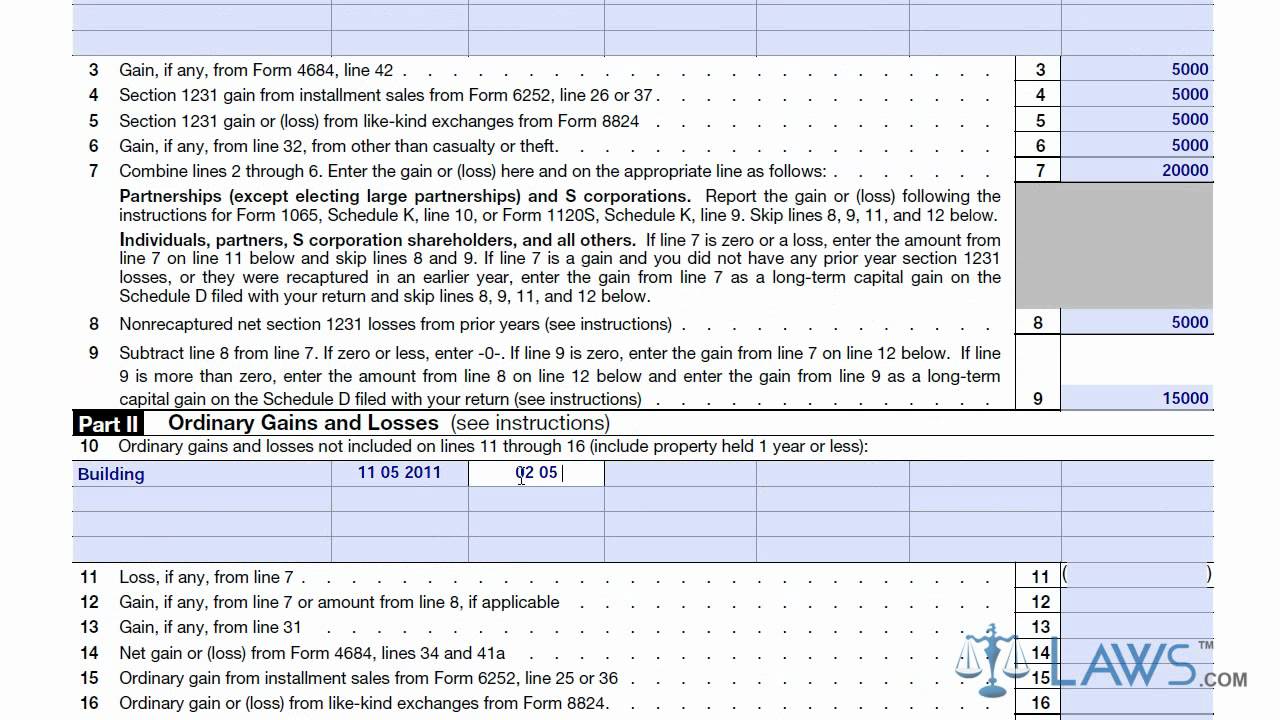

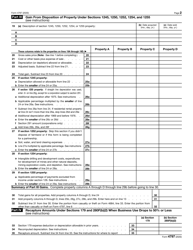

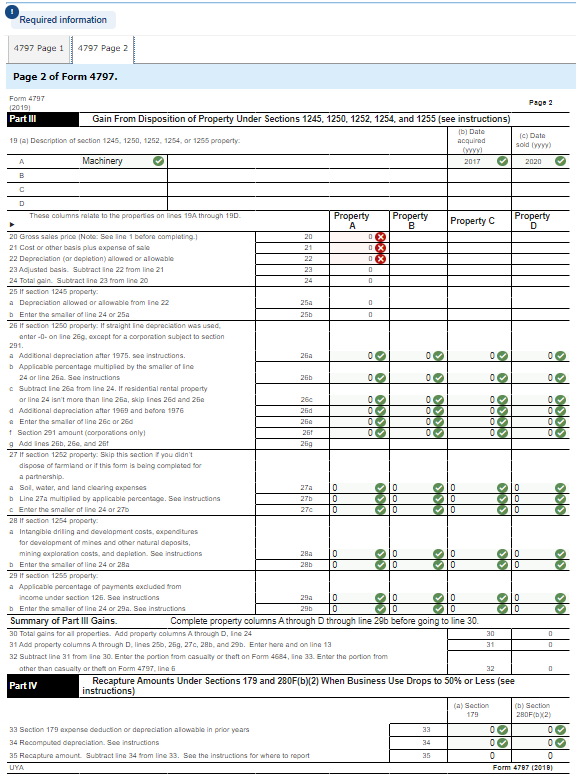

New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street (Medical & Surgical Building), Concord NH4797 Use Part III of Form 4797 to figure the amount of ordinary income recapture The recapture amount is included on line 31 (and line 13) of Form 4797 See the Instructions for Form 4797, Part III If the total gain for the depreciable property is more than the recapture amount, the excess is reported on Form 49 On Form 49,Form 4797 (Sales of Business Property) is a tax form distributed by the Internal Revenue Service (IRS) It is used to report gains made from the sale or exchange of business property, including

Line 7 Of Form 4797 Is 50 8 At What Rate S Is Chegg Com

How To Fill Out Form 4797 Rental Property Property Walls

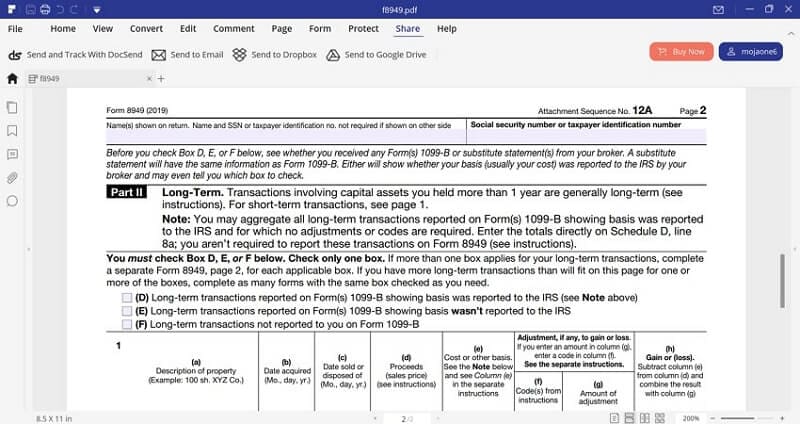

Gains or losses reportable on federal Form 4797, and there is a difference in the gain or loss reportable for Wisconsin and federal income tax purposes, see the instructions for Part II Fill in this part if you sold or otherwise disposed of capital assets during 19 on which gain or loss was recognized, and on whichForm 4797 (17) Page 2 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) 19 (a) Description of section 1245, 1250, 1252, 1254, or 1255 property (b) Date acquired (mo, day, yr)Form 4797 Take full advantage of a electronic solution to generate, edit and sign contracts in PDF or Word format online Convert them into templates for multiple use, include fillable fields to gather recipients?

18 Tax Changes By Form Taxchanges Us

Schedule E Disposition Of Rental Property

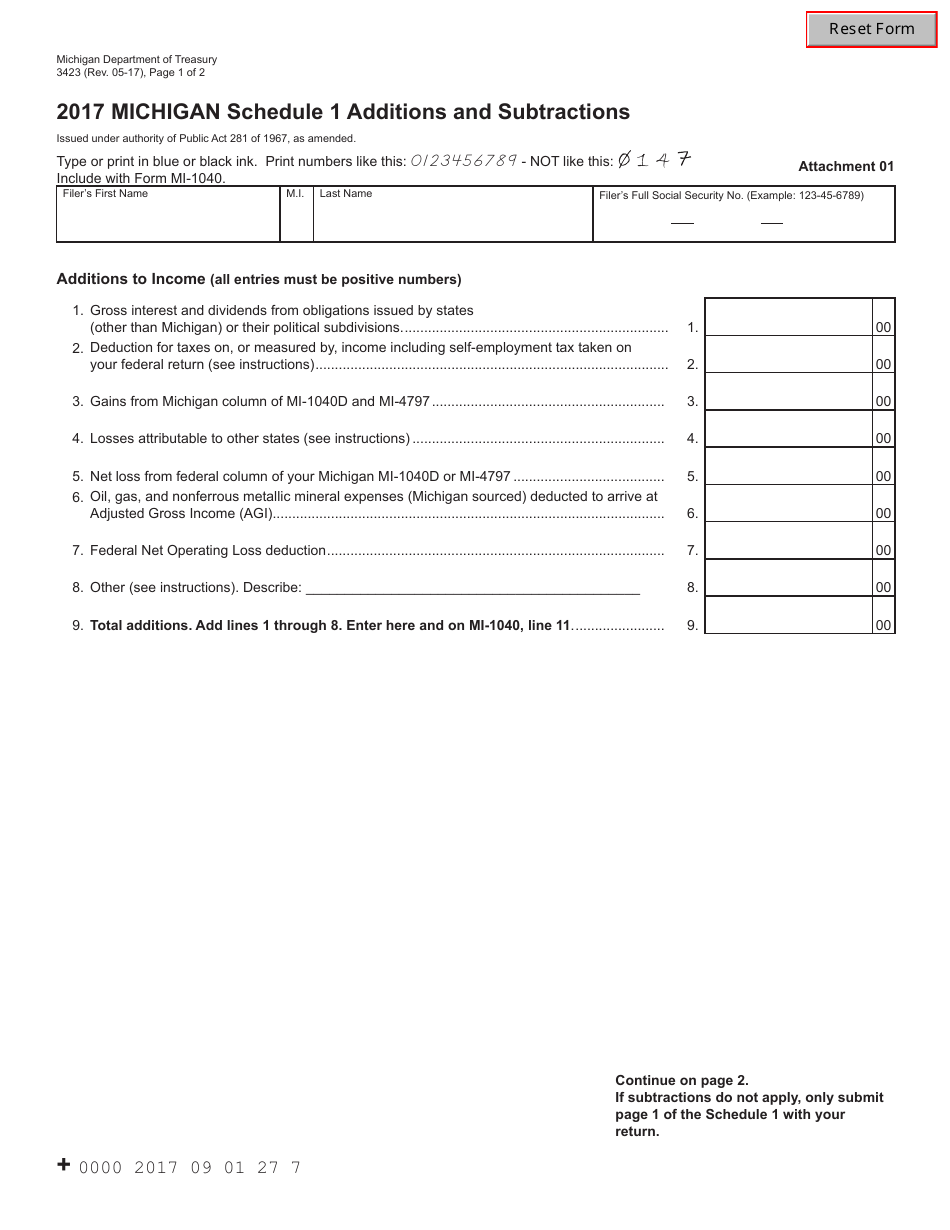

May 31, 19 · The sale of the house goes in Part III of the 4797 as a Sec 1250 Property The sale of the land goes on Part I of the 4797 It gets combined on line 13 of your Form 1040 as a capital asset So the answer to your last question is this does count as two sales on your 4797, but one as a Schedule D capital asset17 Instructions for Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise notedMichigan Department of Treasury (Rev 0517), Page 1 of 2 Issued under authority of Public Act 281 of 1967, as amended 17 MICHIGAN Adjustments of Gains and Losses Type or print in blue or black ink From Sales of Business Property MI4797 Report all amounts in whole dollars Reported on US Form 4797 To be filed with Form MI1040 or MI1041, see instructions

Autosave Off H Actg068a Hw 3 Instructions 19 4797 Abc Inc 7 Prepare 19 Form 4797 For Abc Inc From The Following Information 8 9 Abc Inc Course Hero

Fillable Form 4797 Sales Of Business Property 17 Printable Pdf Download

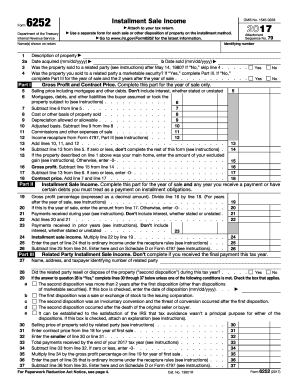

Mar 01, 17 · Form 4797 generally reports the sale of assets utilized in a trade or business as described in IRC §1231 Preparers should be aware that §1231 provisions are applicable to a wide range of parties, including but not limited to individuals, corporations, partnerships, trusts,To the form from screen 4562 or screen 4797 The program then completes Forms 6252 automatically (unless you tell it not to) Use an Installment Sale MFC (multiform code) to tie an installment sale of an asset to a specific Form 6252, entering the data only once, on a screen 4562 or screen 4797The part I like about virtual rather than in person is with most of the modules you can work at your own paceSome of the modules were very basic for those that have been lending for awhile so it was easy to move quickly through and then focus on the cases that were more difficult or had maybe been forgotten over the years

Publication 925 Passive Activity And At Risk Rules Comprehensive Example

Lovely Irs Form 4684 For 17 Models Form Ideas

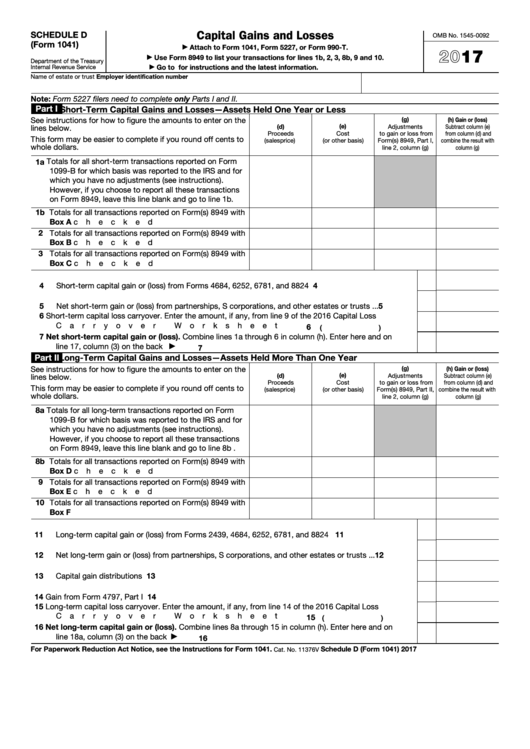

Than $1,1,000 in 17 Issue 1 Buying and Selling on Form 4797, Part I The sales price is $135,000 ($15,000 x 9 acres) His basis deduction is $16,0 ($1,800 x 9 acres) Example 1 p 91 The sale price for the converted wetland acre is $15,000 Because the gain is17 Form 4797 16 Form 4797 16 Form 4797 15 Form 4797 15 Form 4797 14 Form 4797 14 Form 4797 13 Form 4797 13 Form 4797 12 Form 4797 12 Form 4797 11 Form 4797 11 Form 4797 TaxFormFinder Disclaimer While we do our best to keep our list of Federal Income Tax Forms up to date and complete, we cannot be held liableAdrian has a 17 Form 4797, line 9 gain of $56,000 He also has one transaction on his 17 Form 1040 Schedule D, Part I—a loss of $58,000

Taxhow Tax Forms Form 4797

Help I Just Got A 1099 C But I Filed My Taxes Already

The "Wisconsin" Form 4797 with Form 2 STEP 2 If a net longterm capital gain is entered on the "Wisconsin" Form4797, the amounts from the "Wiscon sin" Form 4797 that apply to Wisconsin must be used to complete line 12 of Wisconsin Schedule WD (Form 2) STEP 3 Fill in the amount of ordinary gain or loss comJun 29, 18 · Put simply, IRS form 4797 is a tax form that's used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business property or assets The types of property that often show up on form 4797 include things like property used for generating rental income, as well as property that's employed as partAfter completing the interview for the disposition of the rental property, this transaction will appear on Form 4797 as a gain The full gain will be considered taxable at this point You will then need to complete the Taxable Gain on Sale of Home worksheet in IRS Publication 523 to determine the portion of the gain that qualifies to be

4797 Instructions 21 Irs Forms Zrivo

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Product Number Title Revision Date;The Form 4797 Part III Real Property button is available when you select Sold / Scrapped from the dropdown list in the Method field Click the button to open the Form 4797 Part III dialog The information in this dialog affects only Part III of Form 4797 The application fills in the necessary fields based on data you entered in theForm 4797 is intended for use as a means of reporting a business property sale Any individual who sold a business property or traded the business property during that tax year must complete this form The definition of property for the purposes of this form isn't limited to inhabitable land but also can include oil or mineral properties

/32082667638_810297ef22_k-cabd90e96d994717af9624c12dc728bc.jpg)

Form 4797 Sales Of Business Property Definition

18 Tax Changes By Form Taxchanges Us

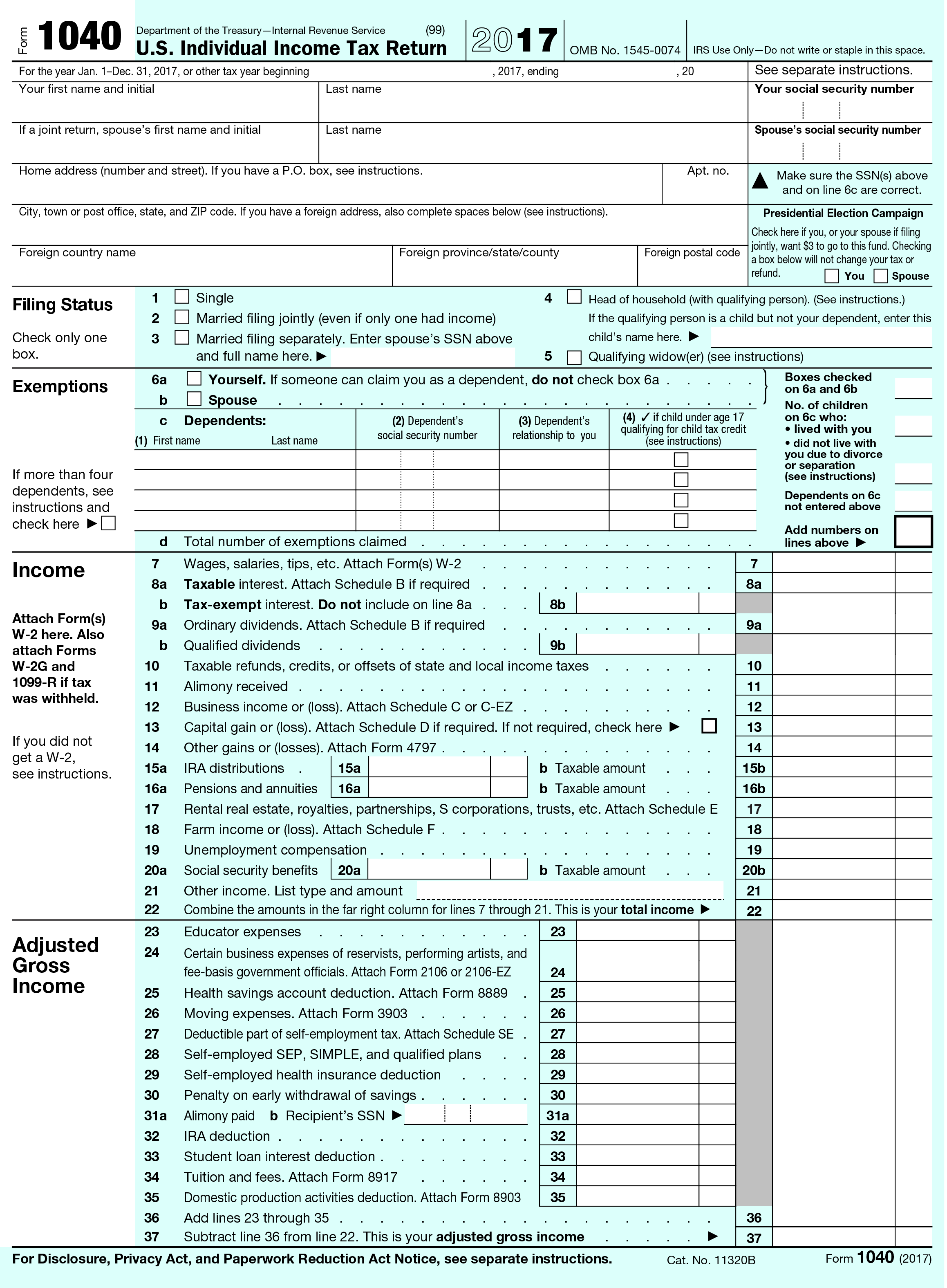

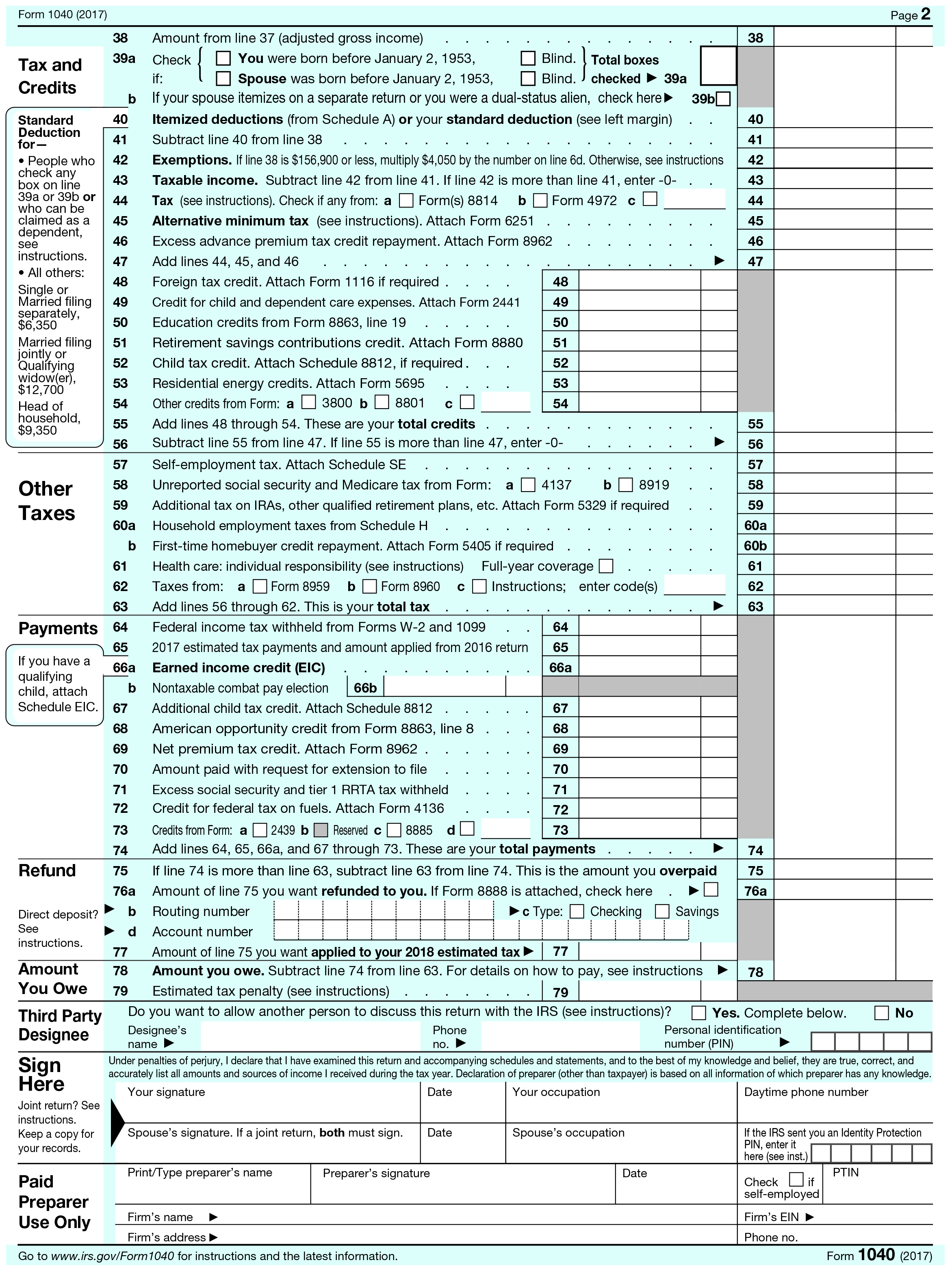

When you've completed Form 4797, enter your resulting gain or loss on line 14 of Form 1040 Then attach Form 4797 to your tax return What is reported on Form 4797?Data, put and ask for legallybinding electronic signatures Work from any gadget and share docs by email or fax Check out now!Form 4797, also known as sales of business property, is an internal revenue serviceissued tax form and used to report gains made from the sale or exchange of business property business property may refer to property purchased in order to produce rental income or a home that was used as a business

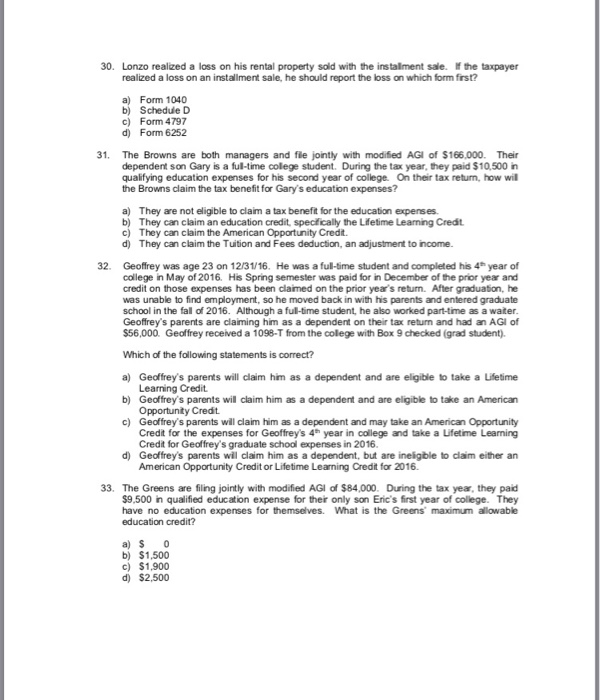

Producer Impacts From The Tax Cuts And Jobs Act Umn Extension

How To Report The Sale Of A U S Rental Property Madan Ca

If the loss on line 11 includes a loss from Form 4684, line 35, column (b)(ii), enter that part of the loss here Enter the part of the loss from incomeproducing property on Schedule A (Form 1040), line 28, and the part of the loss from property used as an employee on Schedule A (Form 1040), line 23 Identify as from "Form 4797, line 18a"New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street (Medical & Surgical Building), Concord NHIf the loss on line 11 includes a loss from Form 4684, line 35, column (b)(ii), enter that part of the loss here Enter the part of the loss from incomeproducing property on Schedule A (Form 1040), line 28, and the part of the loss from property used as an employee on Schedule A (Form 1040), line 23 Identify as from "Form 4797, line 18a"

17 Free Tax Resources And Filing Locations Wilkesboro Nc

How To Report The Sale Of A U S Rental Property Madan Ca

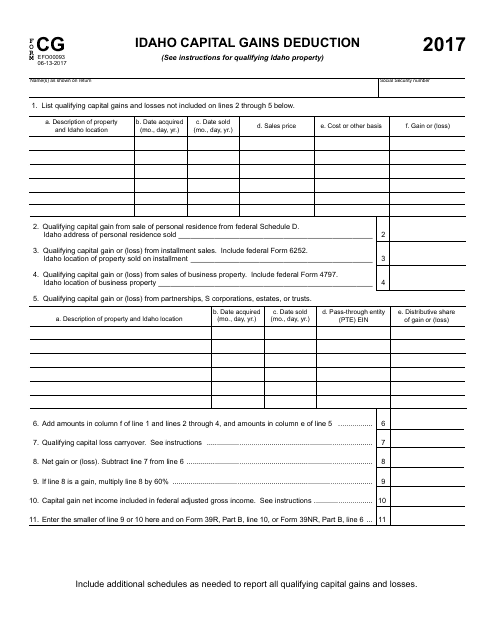

Apr 03, 16 · Investment properties that you sell are reported on form 49, but assets that are used in business are reported on form 4797 For instance if you sell a rental property the sale is reported on form 4797, but if you sell a land that was held for investment only and not for production incomethe sale is reported on form 49 If you sell stocks, bonds, etc these are reported on formPubl 1 Your Rights As A Taxpayer 17 Publ 1 Your Rights As A Taxpayer 14 Publ 1On Form 4797, line 2, enter "Section 1397B Rollover" in column (a) and enter as a (loss) in column (g) the amount of gain included on Form 4797 that you are electing to postpone If you are reporting the sale directly on Form 4797, line 2, use the line directly below the line on which you reported the sale

17 Form Irs 4797 Fill Online Printable Fillable Blank Pdffiller

How To Report The Sale Of A U S Rental Property Madan Ca

On IRS Form 4797, Sales of Business Property, Schedule D (IRS Form 1040), Capital Gains and Losses, and/or IRS Form 6252, Installment Sale Income See paragraph 6 below IRS has made it clear not to report the sale of exchange property on Form 49 when reporting an exchange on FormFile No Stephens Inc October 18, 17 AGENCY Securities and Exchange Commission ("Commission") ACTION Notice Notice of application for an exemptive order under Section 6A of the Investment Advisers Act of 1940 (the "Act") and Rule 6(4)5(e)Information, put and ask for legallybinding digital signatures Get the job done from any gadget and share docs by email or fax

Tax Forms Irs Tax Forms Bankrate Com

Irs 1041 Schedule D Instructions

Form 4797 17 for a onesizefitsall solution to esign form 4797?Apr 02, 18 · On form 4797 you will use accumulated depreciation to have ab adjusted basis You do NOT deduct depreciation on this form So that the only figures on my Sch E are rents received and the usual expenses (taxes, insurance, maintenance fees, etc)?Form 4797 Page 85 Reporting of gains and losses on the 17 $ 2,000 $ 2,000 $ 4,000 18 $ 6,000 $ 2,000 $ 4,000 $0 Example 33 Form 4797 Planning Pointers p 92 If possible, generate § 1231 gains first, then losses in subsequent tax year If § 1231 gains, are infrequent, accelerate any loss to start the 5year recapture

Form 4797 Youtube

From Above View Of 17 Irs Form 1040 On Wooden Desk License Download Or Print For 6 50 Photos Picfair

Mar 25, 19 · I am trying to make an entry to Part III of Form 4797 which is section 1245, 1250 assets I can't figure out ho wto get the asset disposition to show up under Part III of Form 4797 It instead keeps puttin it under Part I of Form 4797• Form 4797, Part IV – business use falls below 50% (§179 or §280F(b)(2)) Less Common Depreciation Recapture LikeKind Exchanges • Installment Sales Author Marc C Lovell Created Date 9/29/17 PMFeb 08, 18 · Form 4797 Example Fill out, securely sign, print or email your irs form 4797 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

Entering Qualified Small Business Stock Qsbs In Drake

Form 3423 Schedule 1 Download Fillable Pdf Or Fill Online Additions And Subtractions 17 Michigan Templateroller

Irs Form 49 The Instructions To Fill It Right

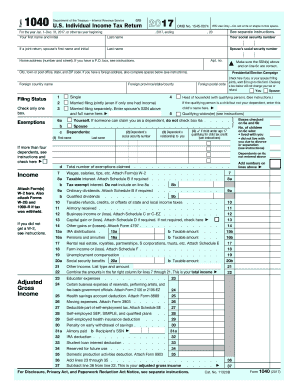

17 Form 1040 Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Form 4797 Rental Property Property Walls

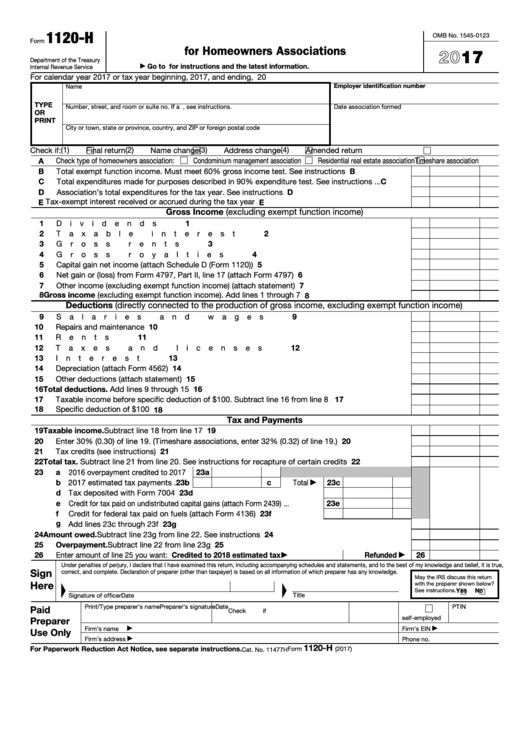

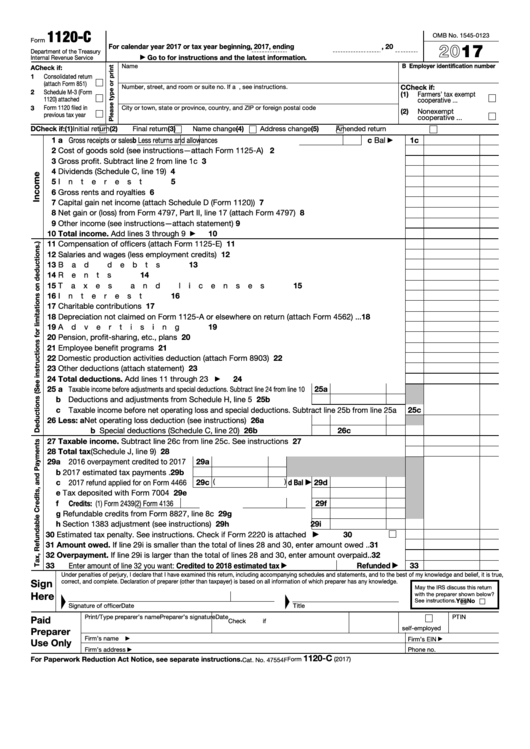

F O R M 1 1 2 0 Y E A R 2 0 1 7 Zonealarm Results

Does The Irs Allow A P O Box Address Amy Northard Cpa The Accountant For Creatives

Form 4797 Sale Of Assets The Good The Bad And The Ugly

Free 17 Printable Tax Forms

Solved Required Information The Following Information Ap Chegg Com

Tax Forms Irs Tax Forms Bankrate Com

Form 4797 Youtube

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Opinion Filing Taxes In Japan Is A Breeze Why Not Here The New York Times

Schedule 3 Non Refundable Credits Everything You Need To Know Walletgenius

18 Tax Changes By Form Taxchanges Us

/GettyImages-157394060-573f646d3df78c6bb0160735.jpg)

Bonus Depreciation And How It Affects Business Taxes

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Basic Schedule D Instructions H R Block

Form Cg Download Fillable Pdf Or Fill Online Idaho Capital Gains Deduction 17 Idaho Templateroller

Dispositions Tab

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Form 67 Fill Out And Sign Printable Pdf Template Signnow

Fillable Schedule D Form 1041 Capital Gains And Losses 17 Printable Pdf Download

Depreciation Forms 4562 4797 Youtube

How To Fill Out Form 4797 Rental Property Property Walls

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

17 Form Irs 4797 Fill Online Printable Fillable Blank Pdffiller

Solved Required Information The Following Information Ap Chegg Com

Opportunity Zones Tax Returns How To

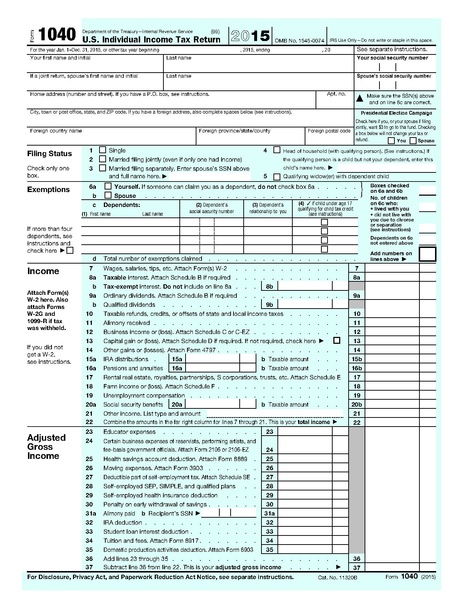

Form 1040 15 Pdf Ieee Technology And Society

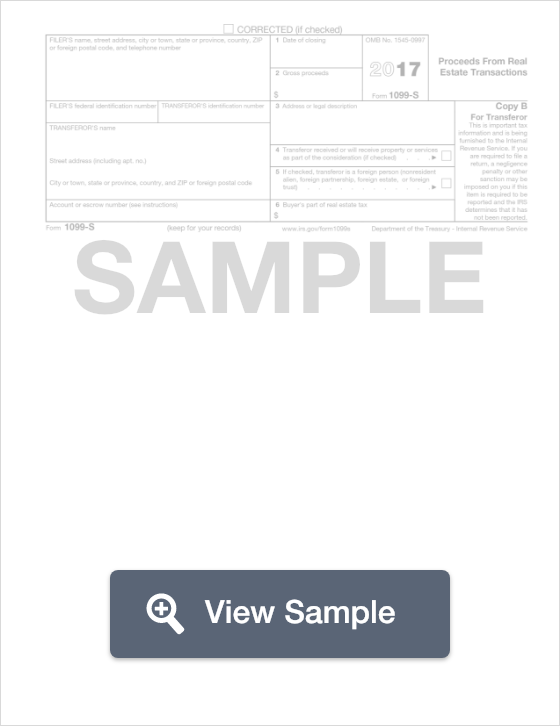

Irs Form 1099 S Real Estate Transactions Your Taxes Formswift

18 Tax Changes By Form Taxchanges Us

Form 4797 Instructions Fill Online Printable Fillable Blank Form 4797 Instructions Com

Sales And Basis Of Assets Presented By Tom O Saben Ea Ppt Download

Prepare E File 990 Forms Online 990 E File Tax Software

Fillable Form 11 C U S Income Tax Return For Cooperative Associations 17 Printable Pdf Download

Sales Of Business Assets Taxconnections

0 件のコメント:

コメントを投稿