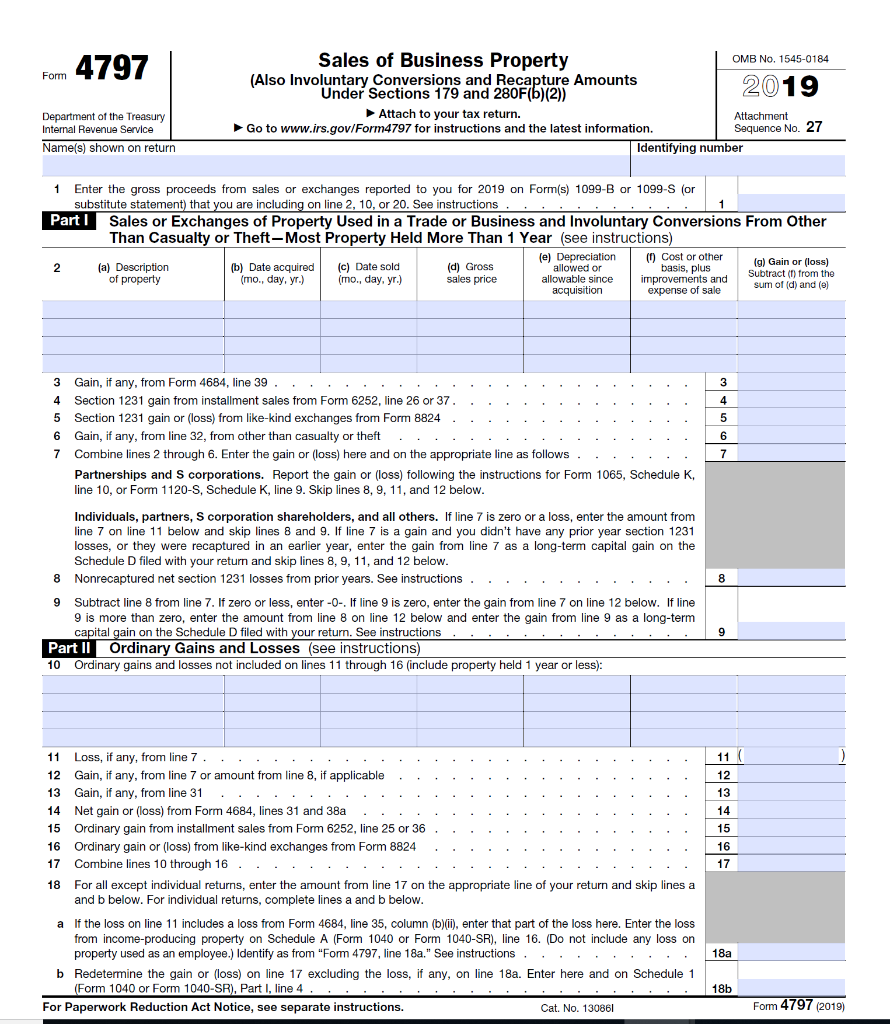

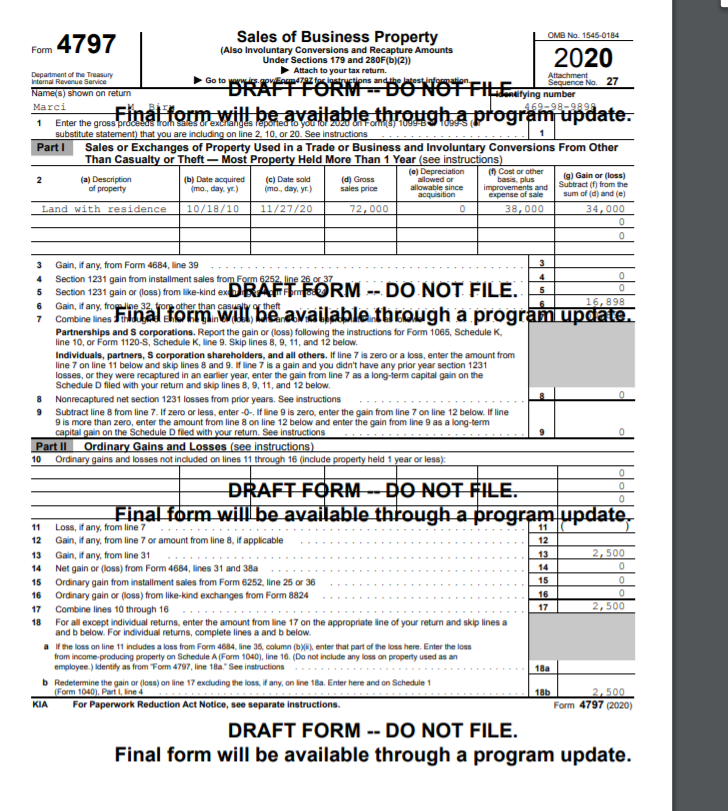

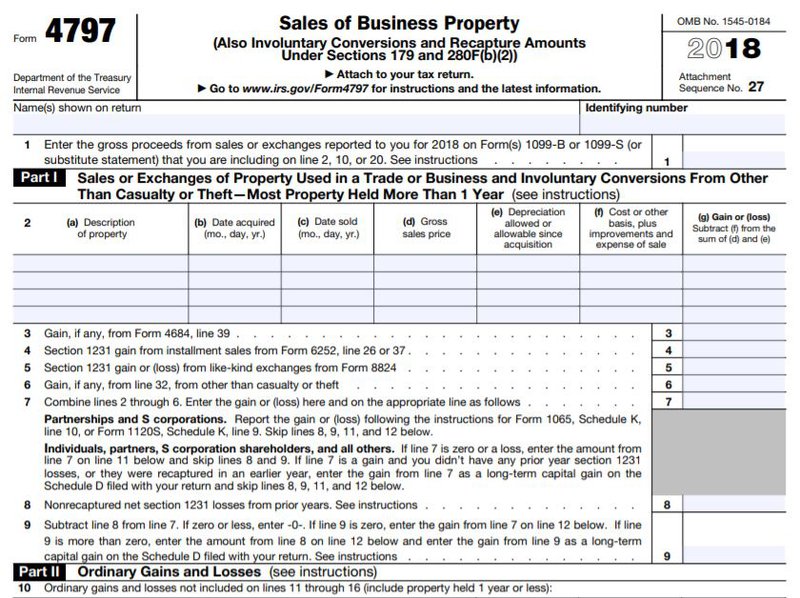

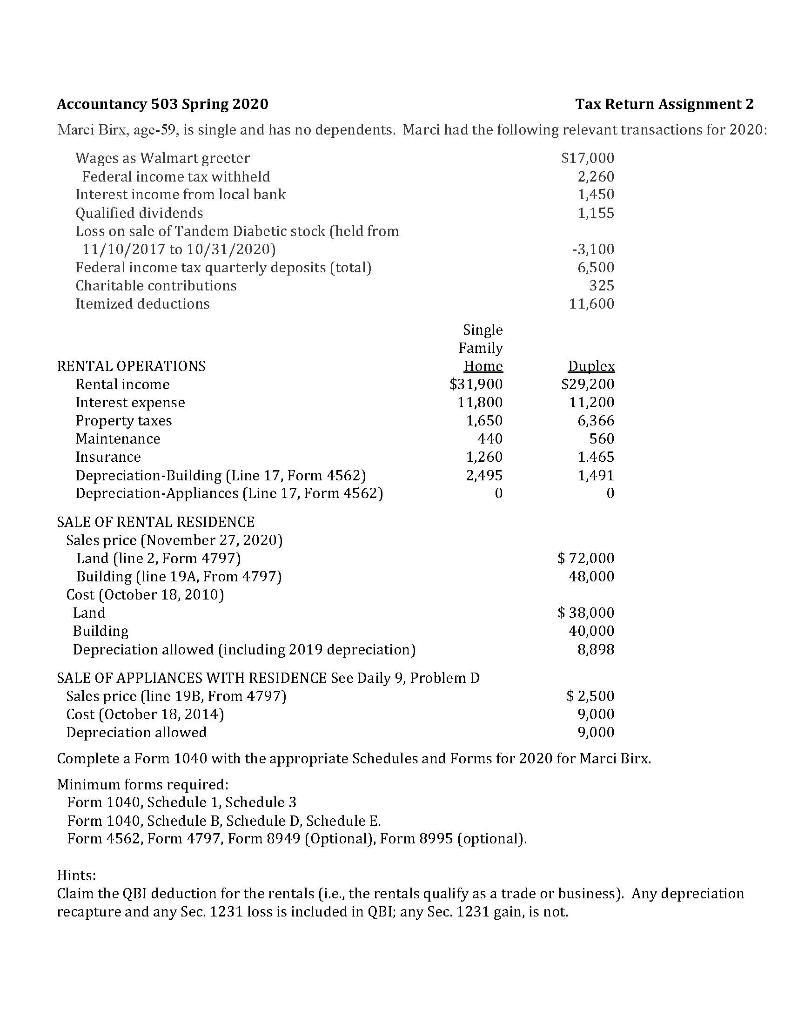

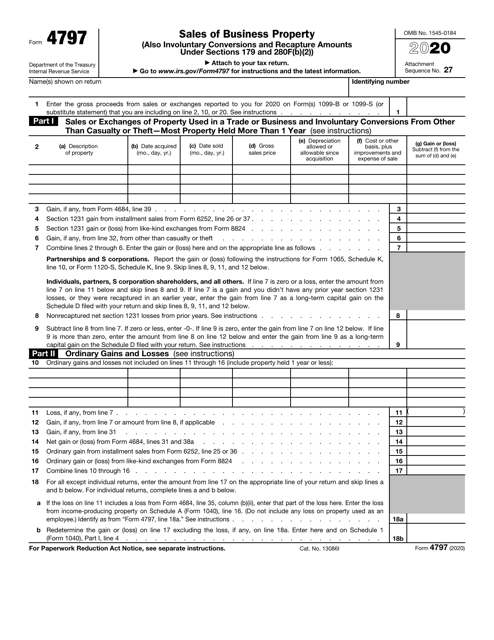

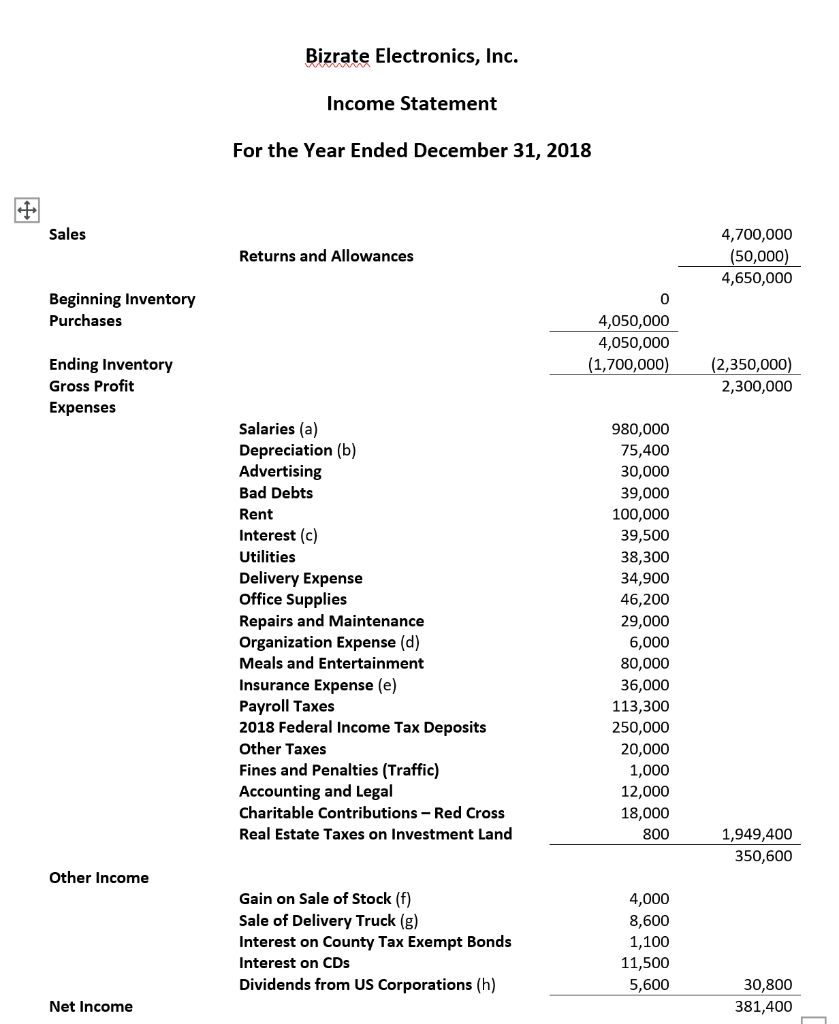

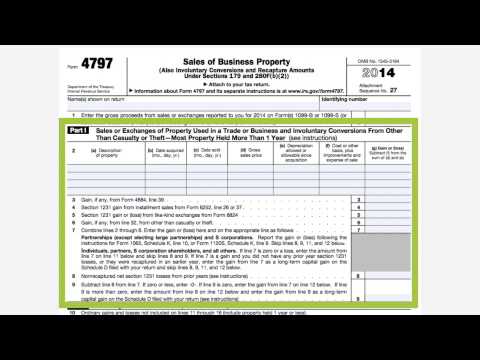

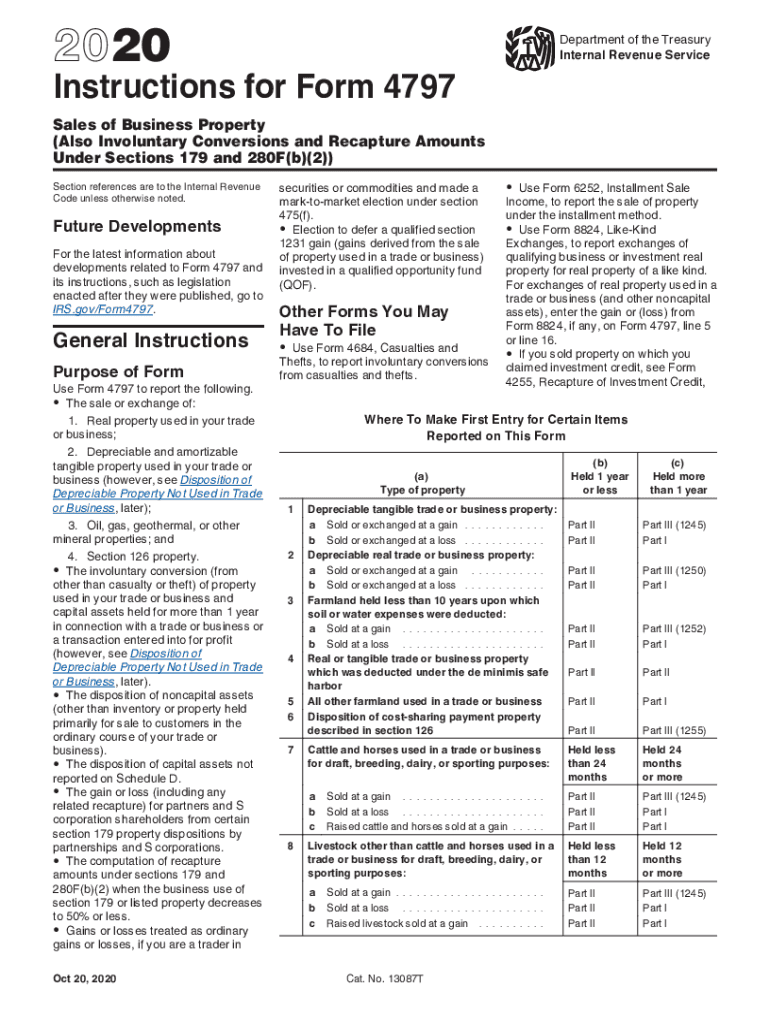

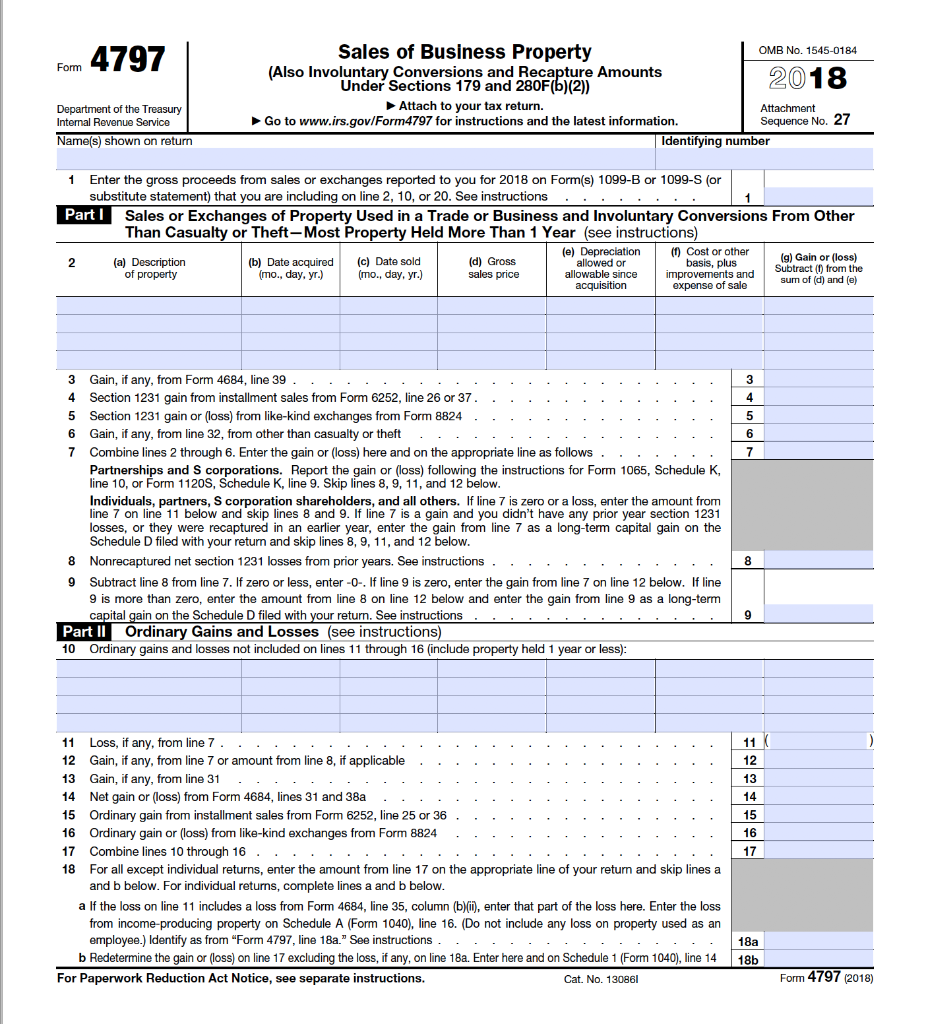

Jan 07, 21 · The IRS form 4797 is a PDF form which can be filled using a PDF form filler application The IRS form 4797 is used to report, Real property used in your trade or business, depreciable and amortizable tangible property used in your trade or business and many other similar propertiesJun 14, 17 · Report the sale of the rental property on Form 4797 If you held the property longer than one year, you must report the sale of the land separately from the sale of the structure Report the sale of the land on Form 4797, Part I How you report the sale of the building depends on if it was a gain or a lossJan 27, · Form 4797 Sales of Business Property is a tax form distributed by the Internal Revenue Service (IRS) and used to report gains made from the sale or exchange of business property, including but not limited to property used to generate rental income, and property used for industrial, agricultural, or extractive

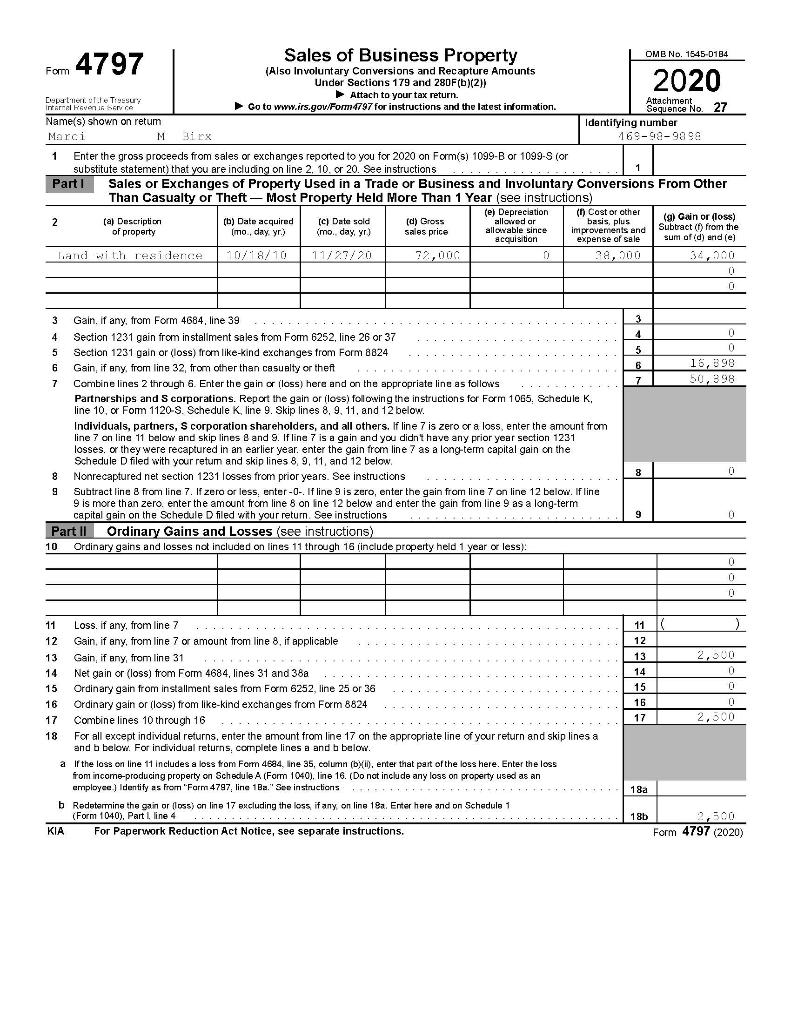

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

How to report sale of rental property on form 4797

How to report sale of rental property on form 4797-Apr 16, 21 · One of these forms may be an IRS Form 4797 The IRS Form 4797 is a tax form distributed by the IRS that is used to report the income generated by the sale or exchange of a business property The properties that are covered by Form 4797 include (but are not limited to) rental properties properties used for agricultural purposesAbout Form 4797, Sales of Business Property Use Form 4797 to report The sale or exchange of property The involuntary conversion of property and capital assets

Irs Form 4797 Guide For How To Fill In Irs Form 4797

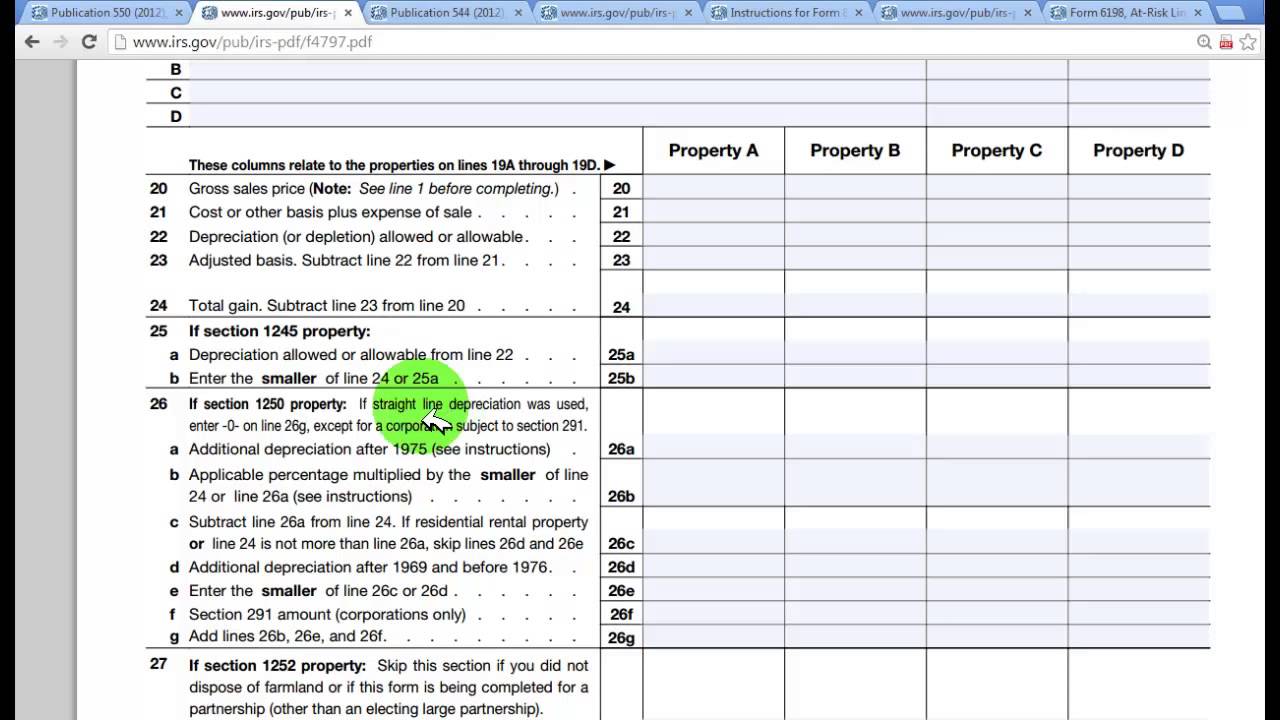

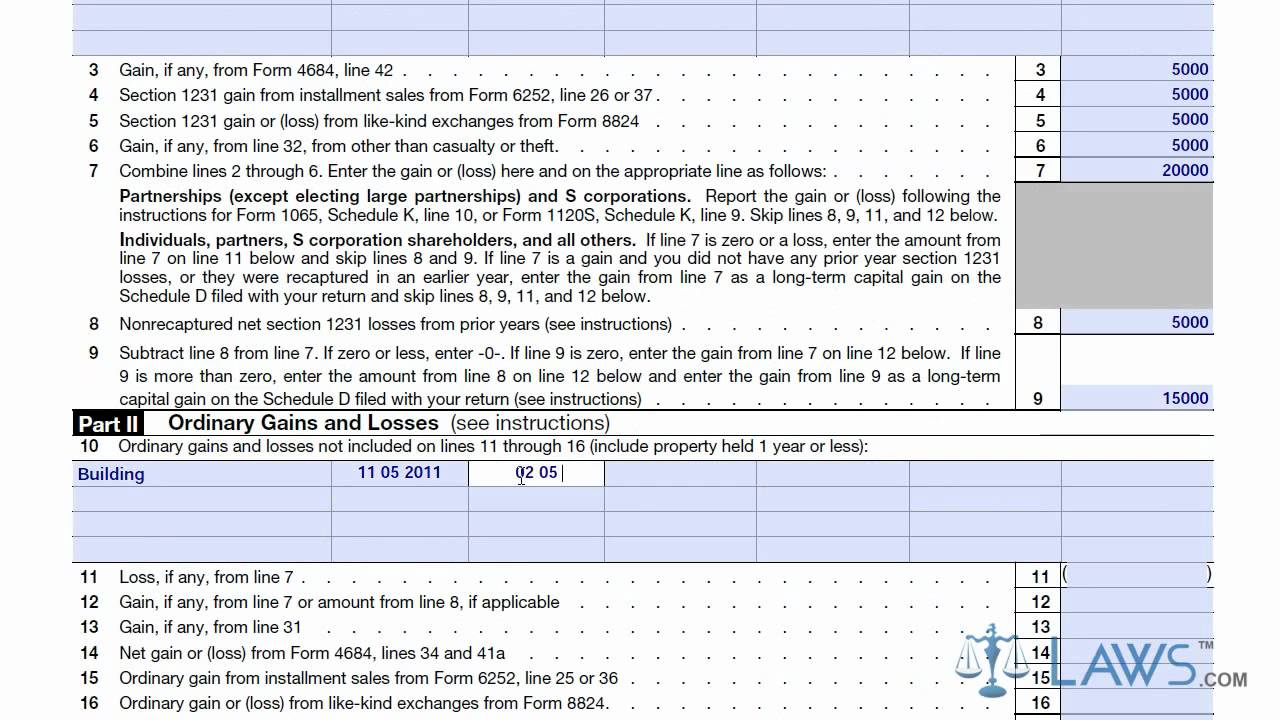

May 30, 19 · The sale of the house goes in Part III of the 4797 as a Sec 1250 Property The sale of the land goes on Part I of the 4797 It gets combined on line 13 of your Form 1040 as a capital asset So the answer to your last question is this does count as two sales on your 4797, but one as a Schedule D capital assetForm 4797 (Sales of Business Property) is a tax form distributed by the Internal Revenue Service (IRS) It is used to report gains made from the sale or exchange of business property, includingMar 02, · Form 4797 is a tax form required to be filed with the Internal Revenue Service (IRS) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income, and properties that are used for industrial, agricultural, or extractive resources

Aug 04, 15 · Both sale transactions for the land and for the building are reported on form 4797 Part 1 as the Sale of Property Used in a Trade or Business and Held More Than 1 Year You are correct if there is a loss on sale of such property, that lossForm 4797 Sales of Business Property Inst 4797 Instructions for Form 4797, Sales of Business Property « Previous 1 Next » Get Adobe ® ReaderApr 02, 18 · It's on the 4797?

Jun 14, · Form 4797 is a tax form required to be filed with the Internal Revenue Service (IRS) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resourcesRefer to IRS Publication 523 for further information To properly report the business or rental portion of the sale on Form 4797, perform the following steps Complete a unit of Screen Sale in the Personal Sale folder using the business or rental amounts for1 What form is used to report the sale of rental property Posted (4 days ago) Jun 05, 19 · June 6, 19 759 AM Yes, you report sale of your rental property on Form 4797 (based on your entries TurboTax prepares it) The gain or loss is reported on your 1040 Line 14 You can enter in Premiere just note the sale of the property is entered under "Sale of Business Property"

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Home Sale Exclusion H R Block

Hello all, I am trying to figure out how to fill out form 4797 for the tax year 13 The duplex was purchased in 07 for $240,000 and sold in 13 for $251,900 It was used as a rental property the entire time and was never owner occupied Here are the factsApr 03, 16 · Investment properties that you sell are reported on form 49, but assets that are used in business are reported on form 4797 For instance if you sell a rental property the sale is reported on form 4797, but if you sell a land that was held for investment only and not for production incomethe sale is reported on form 49 If you sell stocks, bonds, etc these are reported on formThis entry is used to tie the sales price and the recapture type to Form 4797 No entries for depreciation need to be entered on worksheets, unless overrides are needed Property Code entered in line 4 is a required entry, as this designates where the information flows on Form 4797

A Not So Unusual Disposition Reported On Irs Form 4797 Center For Agricultural Law And Taxation

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

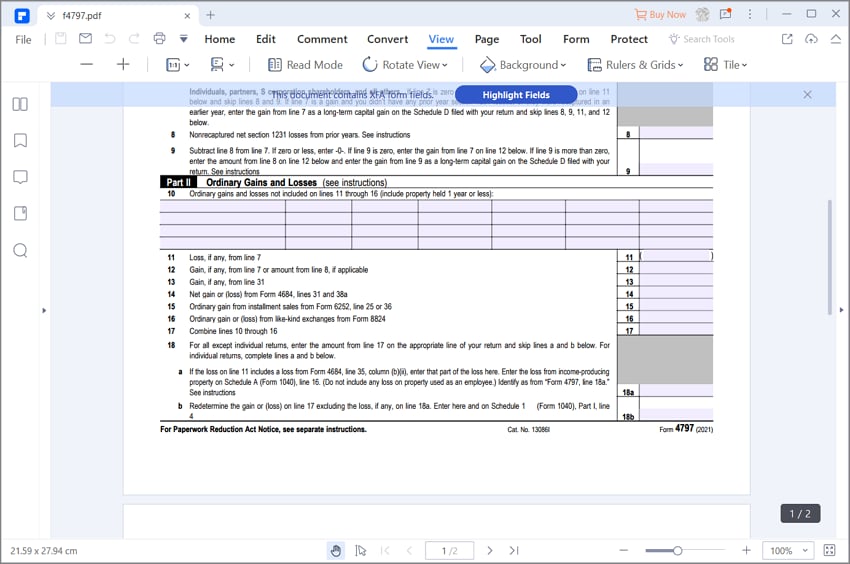

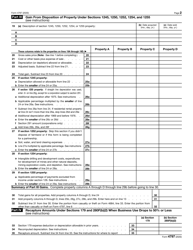

The IRS requires you to report the foreclosure and the resulting gain or loss on a Form 4797 If the foreclosure results in a longterm capital gain, then you also need to include the amount on a Schedule D attachment to your personal tax return However, if you incur a loss, Form 4797 by itself is sufficientWhat is Form 4797, Sales of Business Property?You must also complete and file IRS Form 4797, Sales of Business Property If your rental property is a home, it's a Section 1250 property, so you must complete Part III of the form to determine if you have a gain Then enter the resulting number on line 32 on line 6 of Part I

Form 4797 How And When To Fill It Out Depreciation Guru

How To Sell Rental Property Without Paying Taxes

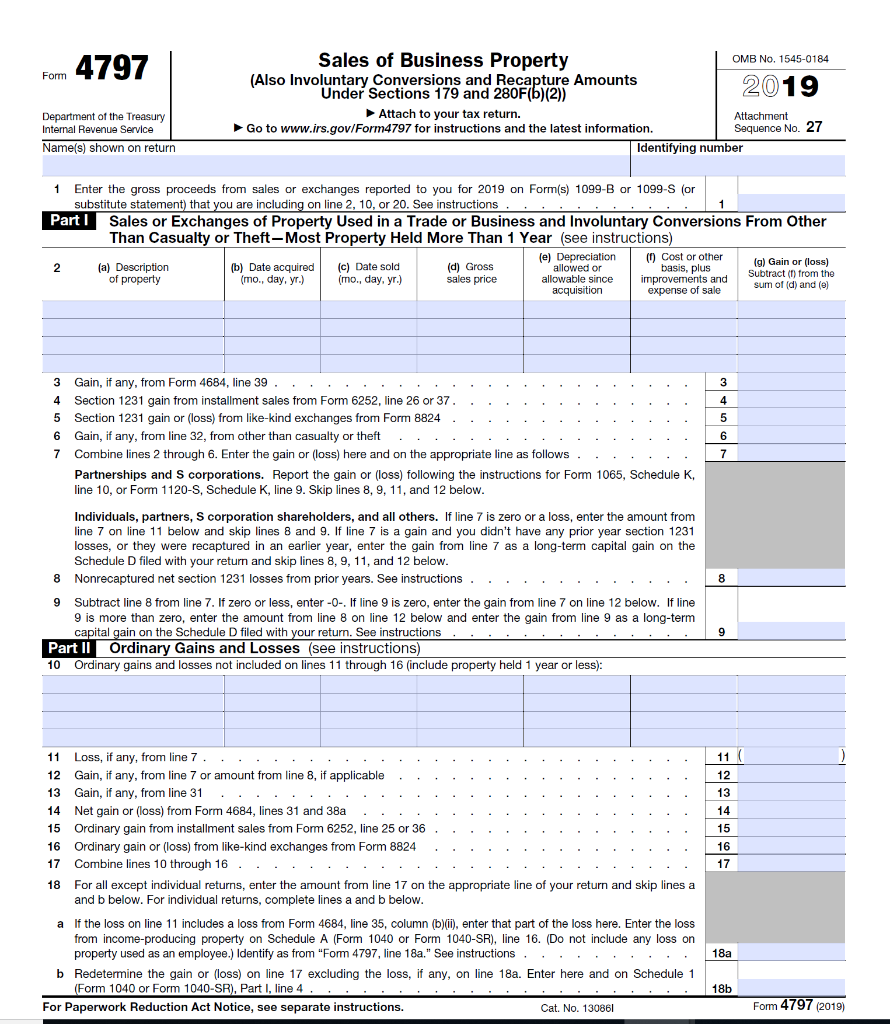

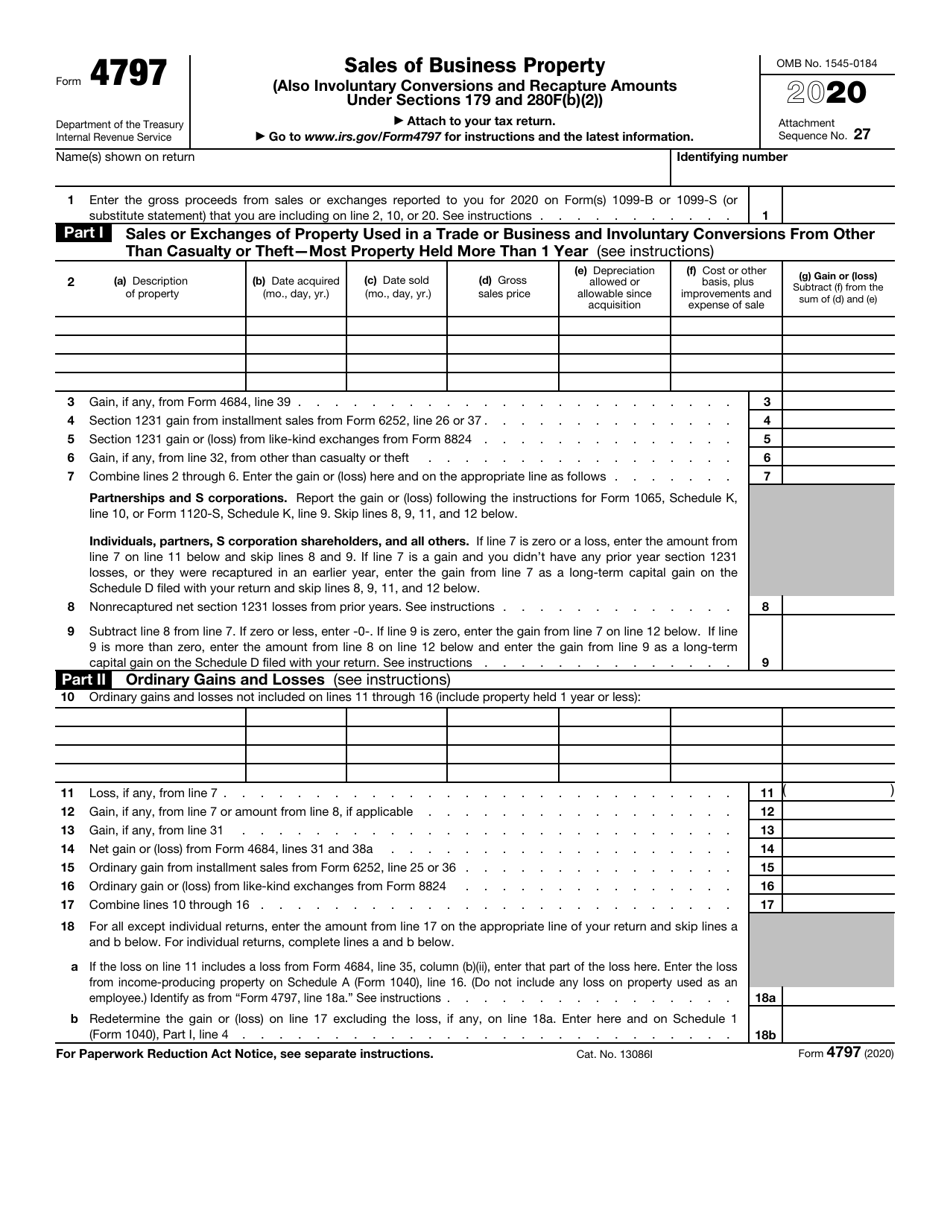

Use Form 4797 to report The sale or exchange of 1 Property used in your trade or business;Oct 16, 19 · Form 4797 Sales of Business Property is a tax form distributed by the Internal Revenue Service (IRS) and used to report gains made from the sale or exchange of business property, including but not limited to property used to generate rental income, and property used for industrial, agricultural, or extractive2 Depreciable and amortizable property;

Form 4797 What Is It Gains On Sale Of Business Property

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Jun 29, 18 · Put simply, IRS form 4797 is a tax form that's used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business property or assets The types of property that often show up on form 4797 include things like property used for generating rental income, as well as property that's employed as partGenerally, Form 4797 is used to report the sale of a business This may include your home that was converted into a rental property or any real property used for trade or business Who Can File Form 4797 Sales of Business Property?If you sold property that was your home and you also used it for business, you may need to use Form 4797 to report the sale of the part used for business (or the sale of the entire property if used entirely for business) Gain or loss on the sale of the home may be a capital gain or loss or an ordinary gain or loss

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Irs Form 4797 Guide For How To Fill In Irs Form 4797

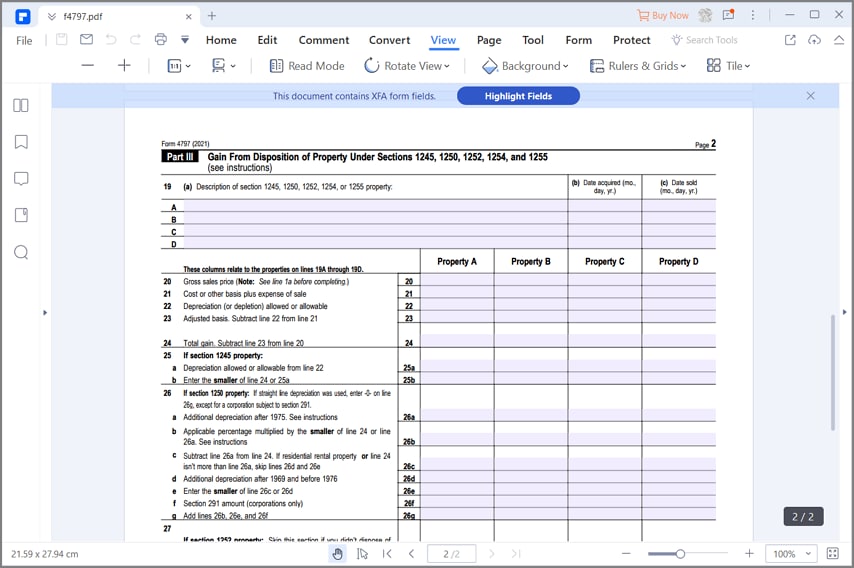

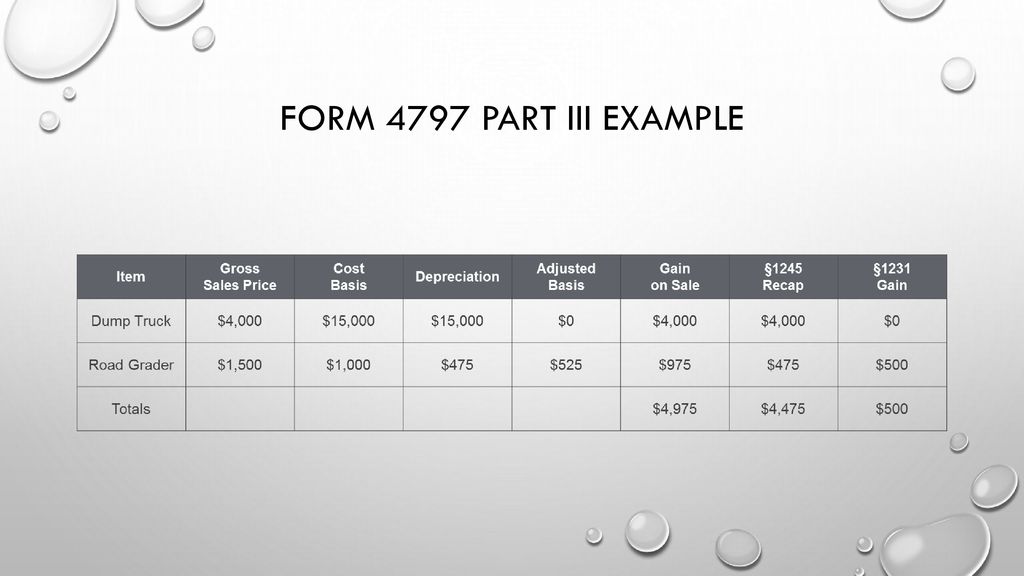

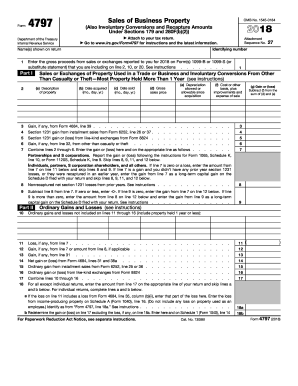

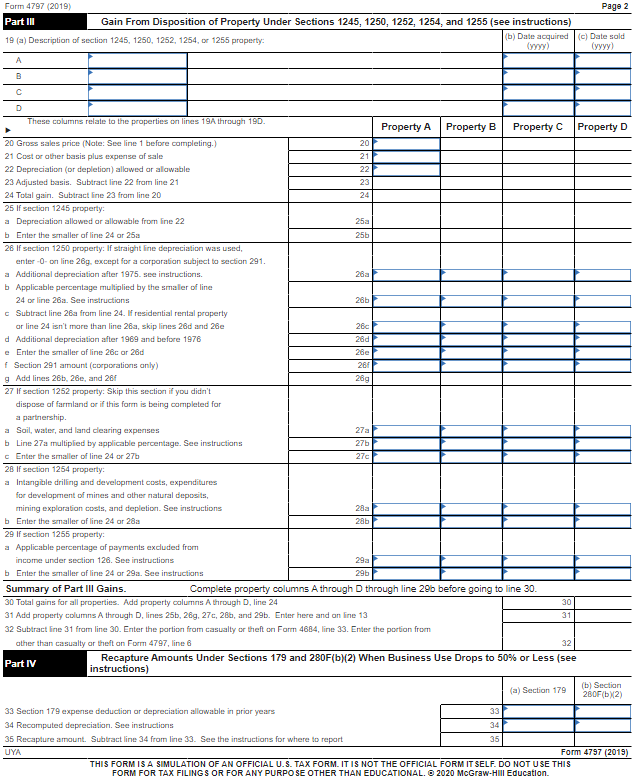

This is an example of using Form 4797 for sales of rental propertyThe disposition of each type of property is reported separately in the appropriate part of Form 4797 (for example, for property held more than 1 year, report the sale of a building in Part III and land in Part I) For more information, refer to the IRS Form 4797, Sale of Business Property, Instructions Was this helpful to you?Form 4797 Part I – most property held more than 1 year Longterm assets sold at a loss Nondepreciable longterm assets sold at a gain Income from Part III, line 32 Nonrecapture net §1231 losses from prior years 6

I Need Help On Evaluating These Tax Return Problem Chegg Com

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

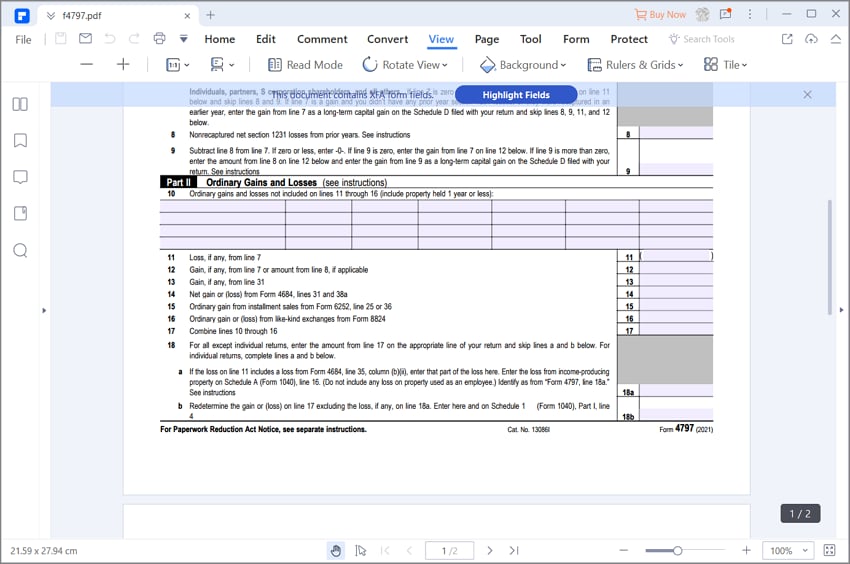

The Internal Revenue Service treats the proceeds from the sale of rental real estate as longterm capital gains Depending on your gain or loss on the sale, you may need to record information about the sale on numerous forms, including Form 4797, Schedule A, Schedule D and Form 1040Also, if you have both installment sales and noninstallment sales, you may want to use separate Forms 4797, Part III, for the installment sales and the noninstallment sales Note If you sold or otherwise disposed of property for which you elected under section179(f) to treat as an expense the costs of certain real property placed in service inAllocate the sales price between the assets So the improvements will have an amount entered, even if it is the same as the Adjusted Basis (resulting in $0 gain/loss) For all assets enter a sales date but leave the sale price BLANK Then manually enter the appropriate numbers on the "Enterable 4797"

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

The sale of a second home held for investment can be entered using the steps above Second Home Rented If the second home was used for rental purposes, or if you previously claimed depreciation on the property, the sale would be reported on IRS Form 4797 Sales of Business Property The sale of a second home used for rental purposes would beCorrect and depreciation as well But not capitalized improvementsDec 06, 19 · Scroll down to the Sale of Asset (4797/6252) section Enter the Sales price (1=none) Scroll down to the Sale of Home section Check the box, Sale of home (MANDATORY to compute exclusion) Check the box, 2year use test met (full exclusion) (If the taxpayer owned and used the home as a main home for 2 or more years during the 5year period

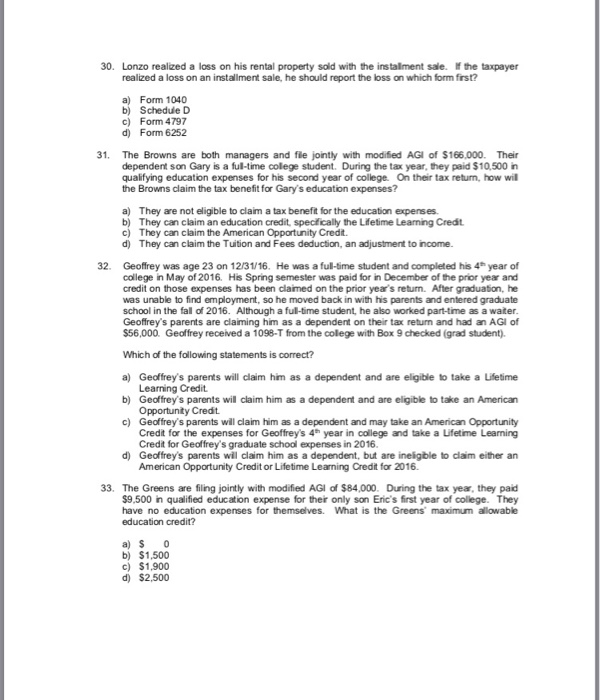

Sales And Basis Of Assets Presented By Tom O Saben Ea Ppt Download

Solved Re How Do I Obtain 121 Exclusion On Portion Of Du

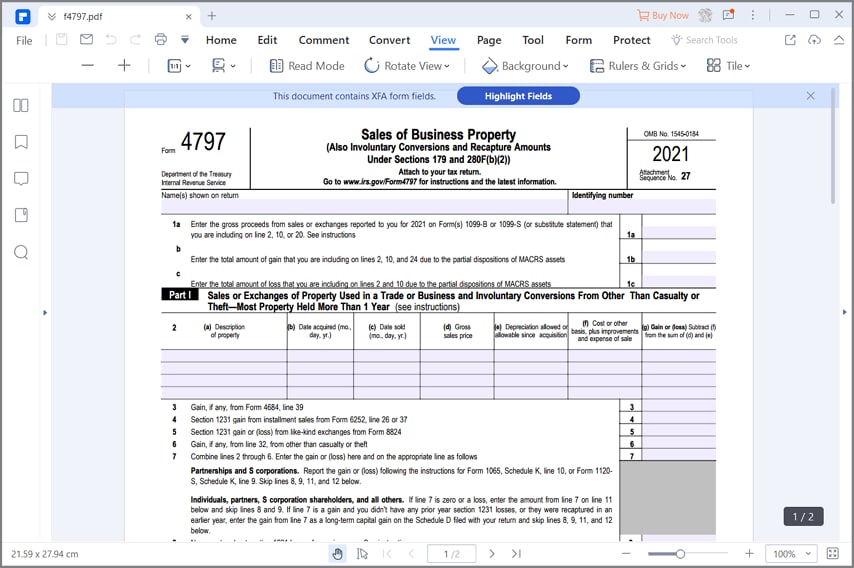

Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No Attachment Sequence No 27 Name(s) shown on returnThe disposition of each type of property is reported separately in the appropriate part of Form 4797 Sales of Business Property (for example, for property held more than one year, report the sale of a building in Part III and land in Part I) For more information, refer to the IRS Instructions for Form 4797After completing the interview for the disposition of the rental property, this transaction will appear on Form 4797 as a gain The full gain will be considered taxable at this point You will then need to complete the Taxable Gain on Sale of Home worksheet in IRS Publication 523 to determine the portion of the gain that qualifies to be

What You Need To Know About Form 4797 Millionacres

/32082667638_810297ef22_k-cabd90e96d994717af9624c12dc728bc.jpg)

Form 4797 Sales Of Business Property Definition

3 Oil, gas, geothermal, or other mineral properties;Visithttp//legalformslawscom/tax/form4797To download the Form 4797 in printable format and to know aboutthe use of this form, who can use this Form 479And 4 Section 126 property The involuntary conversion (from other than casualty or theft) of property used in your trade or business and

Taxalmanac A Free Online Tax Research Resource And Community Discussion Shortsale Personal Residence Converted To Rental

1040 Sale Of Primary Residence Used As Rental

The part of your home you used as a home office if it's not connected to the house;Aug 26, 19 · Rental property tax deductions You report depreciation recapture on IRS Form 4797, Sales of Business Property Click to enlarge Image Source Internal Revenue ServiceVehicles or equipment that you both

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

Sales And Basis Of Assets Presented By Tom O Saben Ea Ppt Download

On form 4797 you will use accumulated depreciation to have ab adjusted basis You do NOT deduct depreciation on this form So that the only figures on my Sch E are rents received and the usual expenses (taxes, insurance, maintenance fees, etc)?How to Report a Sale of Real Estate Property to the IRS Homes Details Gains from the sale of real estate are reported on Form 49 and on Schedule D to Form 1040If you're able to exclude all your gain from taxation, you don't have to report the sale unless you received a Form 1099S Real Estate Is a Capital Asset real estate tax vs property taxYou should report the sale of the business or rental part on Form 4797, Sales of Business Property Form 4797 takes into account the business or rental part of the gain, the section 121 exclusion and depreciationrelated gain you can't exclude

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Oct 12, 15 · This changes your sales price to $586,237 (debt paid of $363,665 plus debt forgiven of $222,572)I Looked over the tax return just prepared by my tax guyQuestion about Line 1 on Form 4797The form instructs1) Enter the gross proceeds from sales or exchanges reported to you for 14 on Form(s) 1099B or 1099S (or substitute statement) thatUse Form 4797 to report The sale or exchange of Property used in your trade or business Depreciable and amortizable property Oil, gas, geothermal, orFeb 18, 21 · I have a question on how to input data for form 4797, specifically the sale of a rental property and Answered by a verified Financial Professional We use cookies to give you the best possible experience on our website

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Line 7 Of Form 4797 Is 50 8 At What Rate S Is Chegg Com

Jun 14, 17 · If you sold businessuse property during the year, you had a gain or a loss on the sale Complete and file Form 4797 Sale of Business Property Businessuse property includes Rental property, like an apartment or a house;Feb , 14 · How do I fill out Tax form 4797 after sale of a rental property?Reporting the sale of rental property (reportable on Form 4797 and Schedule D) From within your TaxAct return (Online or Desktop), click Federal On smaller devices, click in the upper lefthand corner, then choose Federal Click Rent or Royalty Income to expand the category, then click Real estate rental income

How To Report The Sale Of A U S Rental Property Madan Ca

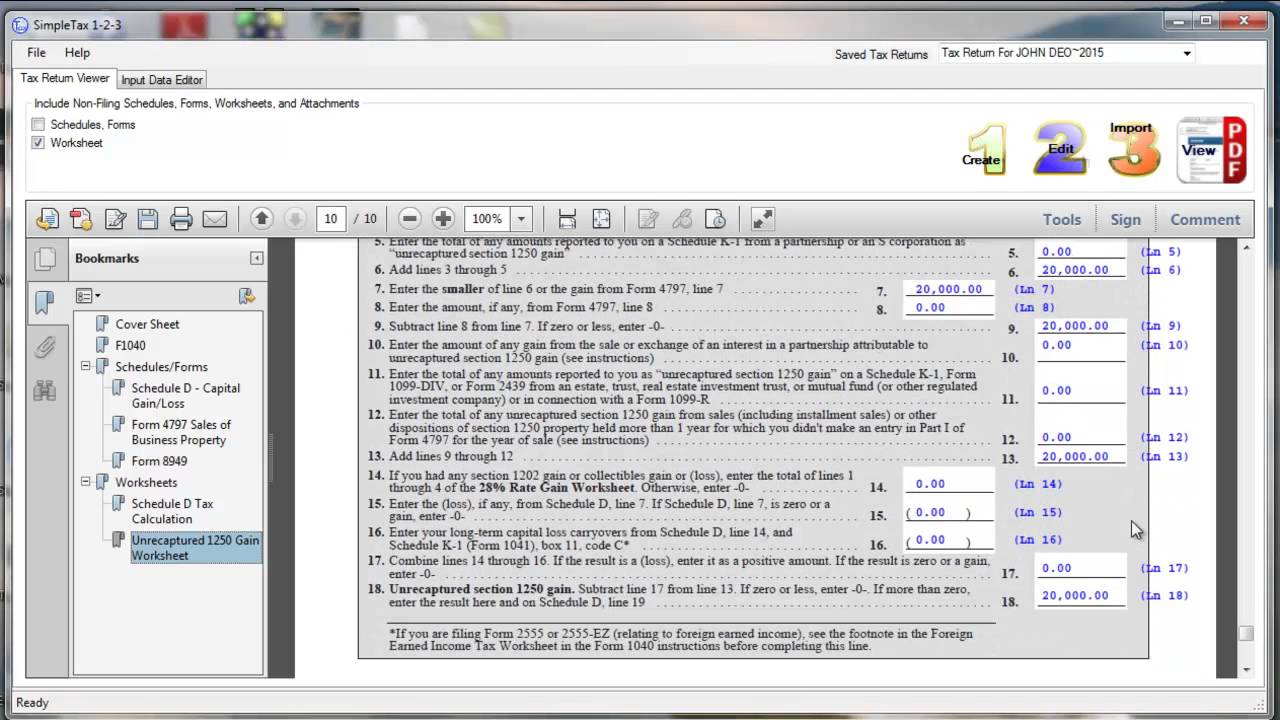

Simpletax Form 4797 Youtube

Jul 30, · Form 4797 is a tax form to be filled out with the Internal Revenue Service (IRS) for any gains from the sale or transfer of property that was used for business purposes This can include but is not limited to any property that was used to generate rental income or a home that was used as a business

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Depreciation Recapture When Selling A Rental Property Millionacres

Depreciation Recapture When Selling A Rental Property Millionacres

How Do I Find Form 4797 Part Iii Lines 19 24 To I

Tax Treatment Of Sale Of Rental Property Youtube

Irs 4797 21 Fill Out Tax Template Online Us Legal Forms

Rental Property Depreciation Rules Schedule Recapture

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

How To Report The Sale Of A U S Rental Property Madan Ca

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

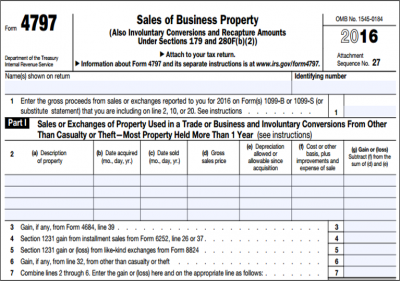

Form 4797 Sales Of Business Property 14 Free Download

Form 4797 Sales Of Business Property

Schedule E Disposition Of Rental Property

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

How To Report The Sale Of A U S Rental Property Madan Ca

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Rental Property Depreciation Rules Schedule Recapture

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

How To Fill Out Irs Form 4797 Real Estate Tax Strategy Wealthfit

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Opportunity Zones Tax Returns How To

What Is Irs Tax Form 6252

Individual Tax Return Problem 5 Form 4797 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 Course Hero

Depreciation Forms 4562 4797 Youtube

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Irs Instruction 4797 21 Fill Out Tax Template Online Us Legal Forms

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

:max_bytes(150000):strip_icc()/GettyImages-174879501-f4ca1ffa3f1d40dfa18aa94a3bbb949c.jpg)

Form 4797 Sales Of Business Property Definition

Schedule D Tax Form 1040 Instructions Capital Gains Losses

Publication 225 Farmer S Tax Guide Chapter Sample Return Preparing The Return

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

Section 1231 And Depreciation Recapture Use This I Chegg Com

What You Need To Know About Form 4797 Millionacres

:max_bytes(150000):strip_icc()/MixedUseInvestmentPropertyMLS-56a580293df78cf772889d38.jpg)

Form 4797 Sales Of Business Property Definition

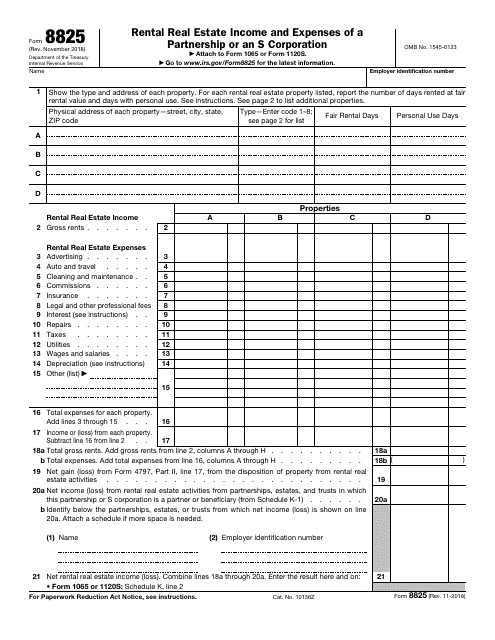

Irs Form 85 Download Fillable Pdf Or Fill Online Rental Real Estate Income And Expenses Of A Partnership Or An S Corporation Templateroller

Fillable Online Sale Of Exchange Property Form 4797 Fax Email Print Pdffiller

Staying On Top Of Changes To The Qbi Deduction 199a One Year Later Wffa Cpas

Line 7 Of Form 4797 Is 50 8 At What Rate S Is Chegg Com

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

The Purpose Of Irs Form 49

Form 4797 Sales Of Business Property 14 Free Download

How To Report The Sale Of A U S Rental Property Youtube

Required Information The Following Information Ap Chegg Com

Form 4797 Sales Of Business Property

How To Fill Out Form 4797 Rental Property Property Walls

Form 4797 Sale Of Assets The Good The Bad And The Ugly

How To Fill Out Form 4797 Rental Property Property Walls

A Not So Unusual Disposition Reported On Irs Form 4797 Center For Agricultural Law And Taxation

Is Rental Property A Capital Asset And How To Report It Taxhub

Irs Form 4797 Guide For How To Fill In Irs Form 4797

0 件のコメント:

コメントを投稿